Big Tech Are Better Placed to Build the Future

Trends suggest that in the battle of innovation and returns, the giants are leaving the little guys in the dust.

Peter Lynch and his affinity for small caps

Look, let's be clear: Peter Lynch was a legend. 29% annualized returns? Come on. That's the stuff of myths. He loved those small caps, the Taco Bells, the Pep Boys. He wrote a whole book about it. "Invest in what you know," he said. And for a while, that worked. Like, really worked.

But here’s the thing about investing in what you know: What you know might be outdated. Lynch’s world, the world of 1989, was a world where a $39 billion General Electric was a giant. He literally said GE couldn’t grow much faster “without taking over the world.”1 Cute. Adorable, even. Today, Apple’s market cap is over seventy times that. Seventy! Times! The world has changed.

Lynch’s thesis, that small caps outperform because they're nimble, used to make sense. But now? Innovation is expensive. Obscenely expensive. And who has money? Big companies. They’d rather throw money at robots than deal with, shall we say, the complexities of human resources.

Robots and Chips: A Tale of Two Expenses

1) Industrial robots

Take robots. Amazon’s warehouses are basically robot theme parks. A million bucks for a starter kit? $20 million for a thousand robots? That’s chump change to Amazon. But try telling your average small e-commerce company to pony up that kind of cash. They’ll laugh you out of the Zoom call.

Amazon, meanwhile, is laughing all the way to the bank, or at least to a warehouse full of tireless, non-unionized robots.

2) GPUs (AI chips)

Then there are GPUs, the fuel of the AI boom. Want to build the next ChatGPT? Prepare to remortgage your house, your car, and your soul. Nvidia’s H100 chips cost $30,000 each. OpenAI, the darling of the AI world, needs hundreds, thousands of these things. They’re talking about raising one hundred billion dollars. That’s not startup money; that’s nation-state money.

OpenAI has said that it expects be the most capital-intensive startup of all time and to raise as much as $100B in the years ahead to pay for the costs of building, training, and hosting future iterations of GPT-*.

Speaking of nation-state money, Microsoft, with its $2.6 trillion market cap, is happily bankrolling OpenAI. Why? Because Satya Nadella, Microsoft’s CEO, wants a piece of Google’s search pie. And he’s willing to pay whatever it takes. One hundred billion is a rounding error to him. He’s playing a different game.

Here's what Microsoft CEO Satya Nadella had to say about his determination to win at search.

I just have to earn one user at a time.2 The most profitable large software business is search. Google makes more money on Windows than all of Microsoft. That alone should give us the impetus to really go after this. - Nadella

Nadella will happily invest ungodly sums of money to raise Microsoft’s market share in search compared to Google, and OpenAI’s ChatGPT represents the most direct challenge to Google’s search monopoly in 25 years. There are, at best, just a handful of tech companies around the world who have both the ability and willingness to take such a large bet.

Big Tech: Your Landlord, Your Lender, Your Everything

Here’s the other thing: small companies depend on big tech. Ramp, the corporate credit card company, put out a list of top vendors for startups. Guess who’s at the top? Google, Facebook, Amazon.

These companies are the infrastructure of the modern economy. They’re selling picks and shovels in the digital gold rush.

What’s most remarkable is these three software services companies have far higher profit margins compared to the other vendors on this list, which include shipping companies, airlines, retailers. These companies operate in the physical world and have the higher cost structure associated with that, whereas software services shift bits around in cyberspace.

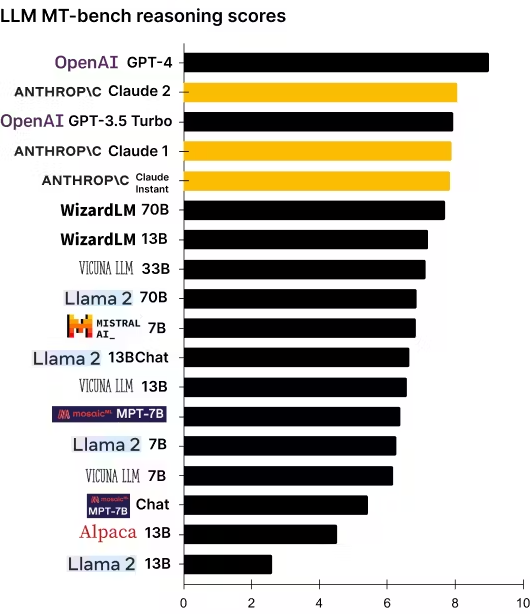

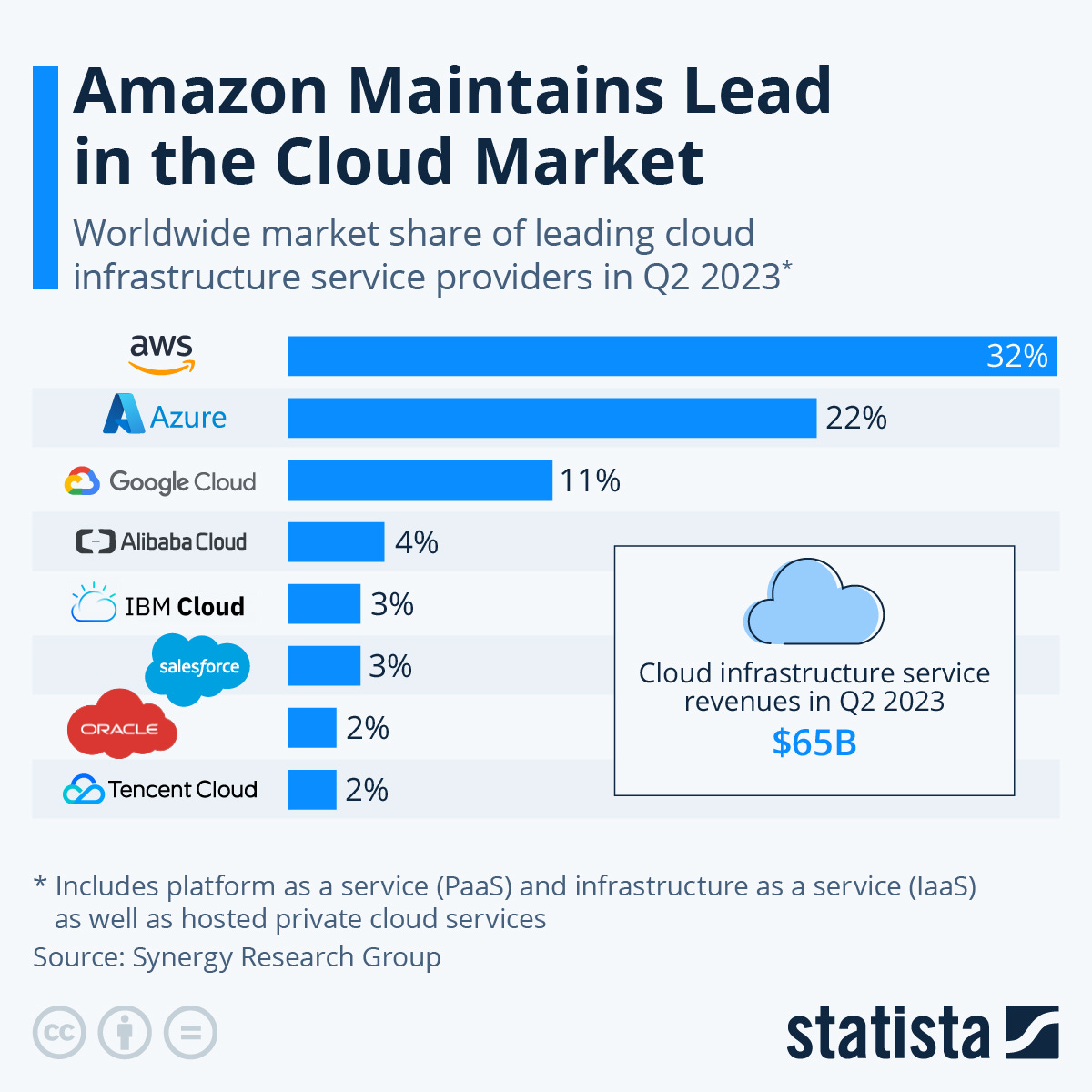

Big tech specifically dominates the expense categories of tech startups. Here is a list of expense categories that tech startups have and the market share of the tech giants in the space.

Digital advertising: Google (29%), Facebook (20%), Amazon (13%)

Digital ad spending as a whole grew 11% in 2022 and has grown double digits annually for several years.

Cloud servers: Amazon (32%), Microsoft (22%), Google (11%)

GPUs (i.e. AI chips3): Nvidia (80%)

AI startups can either buy GPUs directly from Nvidia or more commonly, rent them from the cloud.

Knowing this, it should be unsurprising to learn that a significant portion of venture capital funding goes straight to the top line of big tech companies.

This includes multi-billion dollar investments in AI startups such as Microsoft's investment in OpenAI (spent on Azure), Amazon and Google's investment in Anthropic (spent on AWS and Google Cloud), and Nvidia's investment in CoreWeave (spent on Nvidia GPUs).

The Innovator’s Dilemma: Not a Problem for the Paranoid

Big tech companies aren’t stupid. They know about the Innovator’s Dilemma. They’ve read the book. They’re constantly looking over their shoulders, copying features, launching new products, desperately trying to avoid being disrupted. Facebook cloned Snapchat. Instagram and YouTube aped TikTok. Google is frantically trying to keep up with ChatGPT. This constant paranoia is their strength. Examples:

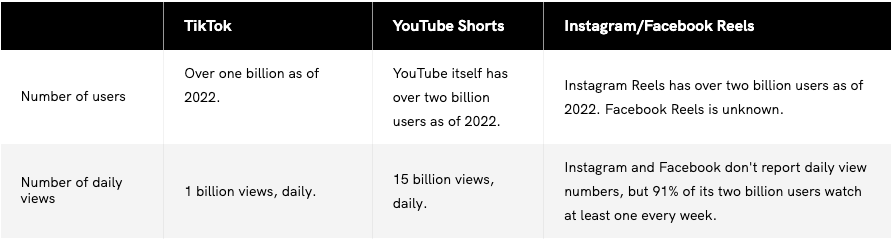

Facebook & Google: To compete with TikTok's short video format, Instagram released Reels in 2020 and YouTube introduced Shorts in 2021. The user base and viewership on both have already exceeded TikTok.

Source: Android Authority Facebook: In 2017, after suffering from declining engagement of young users, Facebook ripped off Snapchat's features and put them into Instagram, WhatsApp, and Facebook. Today, after a spike in 2020-22, Snap is down 64% since its 2017 IPO while Facebook is up 120%.

Google: In response to the success of ChatGPT in Nov 2022, CEO Sundar Pichai declared a "code red", in recognition of the fact that AI chatbots could replace Google Search and kill its core business. Google has since integrated AI features across the company's suite of tools.

Only time will tell if Google can hold onto its formidable 90%+ search market share. So far for 2023, it certainly has.

Apple: In 2014, after years of touting the benefits of small phone screens, Apple released the iPhone 6 with larger screens to fend off Android competitors. Since then, Apple stock is up more than 3x compared to Samsung.

Microsoft: Under CEO Satya Nadella, the company embraced open source software after decades of staunch opposition under Bill Gates and Steve Ballmer.

Nadella pivoted Microsoft from selling desktop Windows and Office to selling subscriptions through the cloud, with Azure and Microsoft 365 (formerly Office).Nvidia founder and CEO Jensen Huang bet the whole company on GPUs more than 10 years ago.

We saw early on, about a decade or so ago, that this way of doing software could change everything. And we changed the company from the bottom all the way to the top and sideways. Every chip that we made was focused on artificial intelligence. - Huang

Now, Nvidia GPUs power the AI revolution.

Amazon turns expenses into new business lines:

servers -> AWS: for startups that didn't want to buy servers before launch and companies that wanted to flexibly purchase compute

website -> Amazon Marketplace: for third party sellers to make more sales

warehouses -> Fulfillment by Amazon: two-day shipping for third party sellers

logistics -> Amazon Flex delivers for the most profitable package delivery routes, leaving costly, rural routes to USPS

That’s just a few examples of Amazon of using outside revenue to boost its own scale, make its service highly cost competitive, and gain market share.

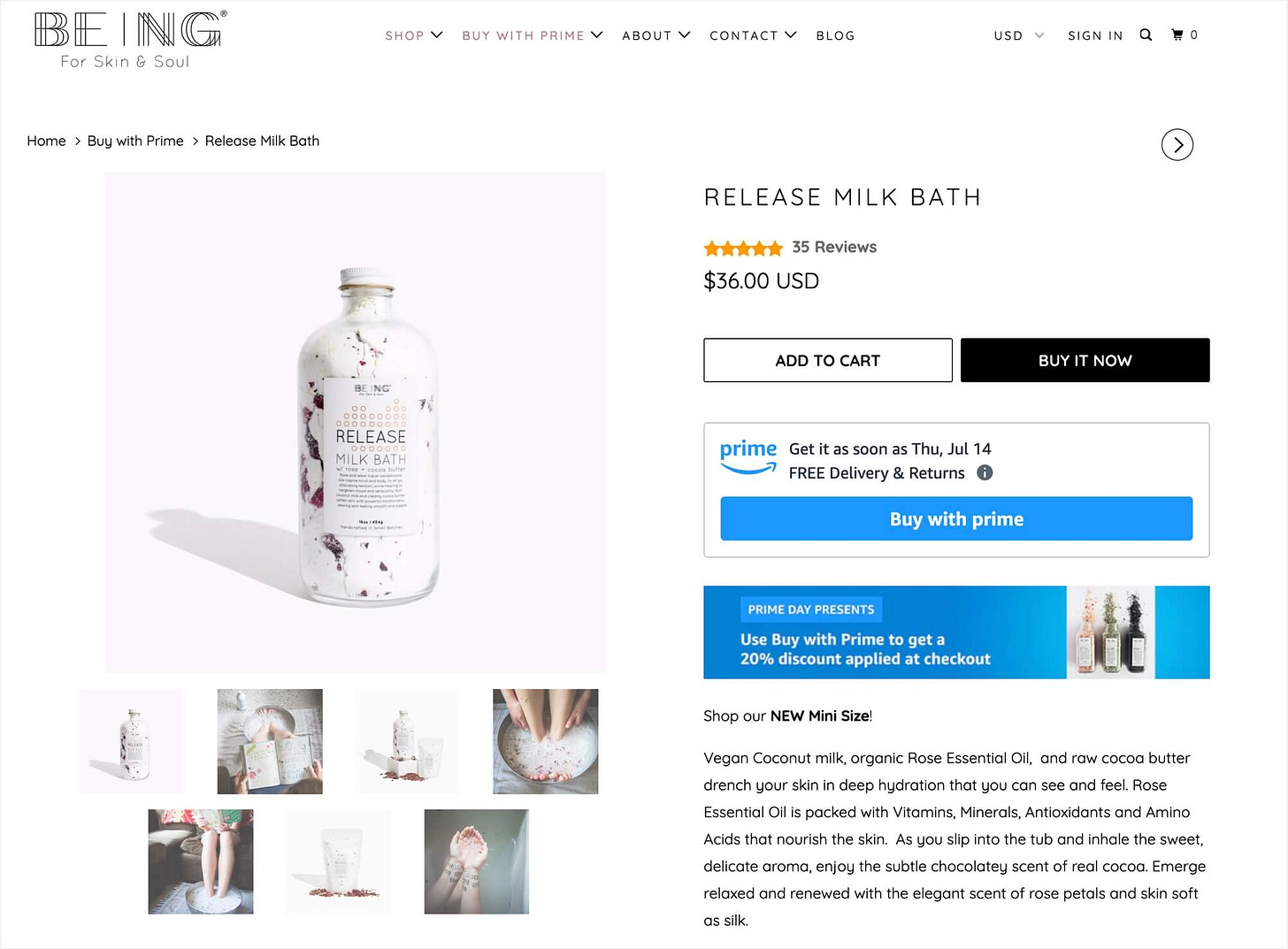

Amazon released "Buy with Prime" in 2022, which takes advantage of customer expectations for free, fast shipping to entice Shopify merchants to use Amazon logistics, hurting Amazon Retail's main competitor Shopify.

Amazon Logistics, "thanks to the sheer expense necessary to build it out, has a nearly impregnable moat that is not only attractive to all of the businesses competing to be consumer touchpoints — thus increasing Amazon’s addressable market — but is also one that sees its moat deepen the larger it becomes."

Shopify lacks the logistics capacity to offer the same service at a competitive cost, giving it no choice but to provide the ability for merchants to enable customers to turn over transaction data and revenue to its primary competitive threat, Amazon.

Shopify product page with “Buy with prime”. Source: Marketplace Pulse

Bezos on The Innovator’s Dilemma

In all of these examples, big tech leaders are keenly aware of the perils of the Innovator's Dilemma. They know they must innovate even if it risks cannibalizing an existing business line because otherwise, some other company will eventually kill their business.

Early Amazon executive Dan Rose described the degree to which Jeff Bezos internalized the Innovator's Dilemma. In 2004, Bezos told Steve Kessel, the head of Amazon's books, music, and video business at the time:

Effective tomorrow, you've been fired from your job of running our core business. […] Your new job is to build a digital media business. You're the only employee of that team. Go build a new team and your job is to kill your old business. (emphasis added)

Amazon’s entire revenue at the time came from books, music, and video, so Bezos’ decision was ridiculously bold.

Companies whose management teams deeply believe they must continually reinvent themselves, even if it comes at the risk of disrupting their existing business, are the ones who will dominate the economy of the future.

This vigorous competition between these top tier companies will be a forcing function for their continuous improvement, protecting their continued dominance.

Antitrust? Please.

Remember when the government broke up Standard Oil and AT&T? Those were the days. Now? We have five tech giants with trillion-dollar market caps. The government is outgunned, outmanned, and outspent. Lina Khan’s FTC tried to block Microsoft’s Activision deal. They lost.

The giants are too big. They have armies of lawyers. They poach former FTC officials. They’re playing chess while the government is playing checkers.

The US government failed to break up Microsoft in its landmark case, when it was the only tech giant with a market cap exceeding $500b (or $924b in 2023 dollars).

Now, there are five tech giants that are the same size as or larger than Microsoft in 1999, with >$1 trillion market cap: Apple, Microsoft, Google, Amazon, Nvidia.

This divides the government's resources over several cases, reducing the likelihood of the government's success in each individual case.

Each mega-cap company has significant financial resources and can afford to hire top-notch legal teams to fight antitrust cases. This gives them a serious advantage over regulatory agencies that don't have the same level of resources at their disposal.

Conclusion

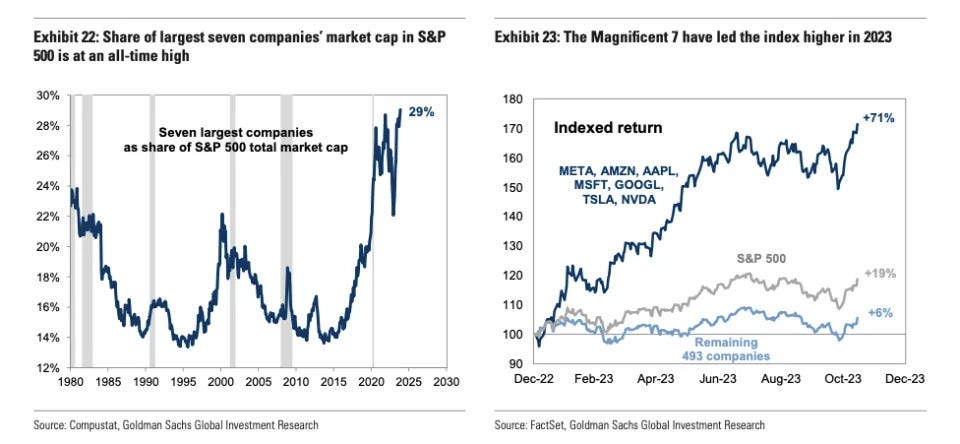

The 2023 market rally was all about the “Magnificent Seven” tech stocks. That’s not a coincidence. It’s a sign of the times4. Big is getting bigger. We’re going to see $5 trillion, $10 trillion companies. It’s inevitable.

This is not to say there won't be successful startups in the future; there definitely will be. But they will either need to be niche or exceedingly well capitalized and preferably backed by big tech, e.g. OpenAI, Anthropic.

Otherwise, their returns on invested capital are unlikely to outpace mid to large cap tech.

Today, the most valuable company in the world is Apple at $2.8 trillion.

Prediction: We will see $5t and $10t companies within our lifetimes.

The increasingly capital intensive nature of technological innovation, the fiercely competitive arena of big tech, management’s active avoidance of the Innovator’s Dilemma, and the inadequacy of antitrust regulation to limit the dominance of large corporations all give a significant edge to the largest, most well-funded companies of our time.

April 2024 update

Exactly as expected:

The gap in expected NTM net income between mega-cap tech and the bottom 493 of the S&P is widening.

In 1989, he wrote in his bestselling investing book One Up on Wall Street:

General Electric is a great, well-run company with a $39 billion market cap, but "there is simply no way that GE could accelerate its growth very much without taking over the world. And since fast growth propels stock prices, it's no surprise that GE moves slowly as La Quinta soars."

"Everything else being equal, you'll do better with the smaller companies."

This post was researched in part with Bing Chat, which, unlike OpenAI's ChatGPT and Anthropic's Claude, cites sources in its answers, so Nadella has already earned one searcher.

AI functionality of any kind relies on computation by GPUs, whether companies choose to use closed source LLMs from Microsoft-backed OpenAI and Amazon and Google-backed Anthropic or open source LLMs.