The Hall of Shame: 25 Stocks That Went from Boom to Bust

A Journey Through the Biggest Wealth Destroyers in U.S. Market History

There’s a certain charm to the idea that stocks never really die. Sure, you can see companies go bankrupt, get delisted, or get absorbed into larger, more successful companies. But, in the end, the assets live on, like a corporate Frankenstein’s monster cobbled together from the pieces of the fallen. This is one of the more comforting myths of capitalism: creative destruction ensures that even the worst failures still contribute something to the economy, however indirectly. And if you’re an optimist, you might even believe that the value they destroy for one set of shareholders could be recouped by another.

So today, we’re going to take a look at the 25 worst stocks in U.S. history, according to a list compiled by Visual Capitalist. These are the companies that, for one reason or another, managed to destroy billions of dollars of shareholder wealth. Some of them are familiar names, others are more obscure. But all of them are united by one thing: they were really, really bad investments.

The one significant Berkshire Hathaway investment is #16 Kraft Heinz; Berkshire still owns 27% of the stock

Now, before we dive in, a quick word on Warren Buffett. We all know Warren Buffett is the Oracle of Omaha, the guy who can do no wrong when it comes to investing. But even Buffett isn’t infallible. Case in point: #16 Kraft Heinz. Berkshire Hathaway still owns 27% of Kraft Heinz, a stock that has managed to destroy $35 billion in shareholder wealth. Not exactly a ringing endorsement of the value-investing philosophy.

To be fair, Buffett has acknowledged that Kraft Heinz hasn’t been his best investment. He’s even said that he overpaid for the company. But the fact that Berkshire still owns such a large stake suggests that he’s not quite ready to throw in the towel. Maybe Kraft Heinz will turn things around. Or maybe it’ll continue to languish, dragging down Berkshire’s returns. Only time will tell.

Full list of the 25 worst stocks

Let’s get to the list itself. It’s a rogues' gallery of companies that, for one reason or another, managed to lose billions of dollars for their shareholders.

1. WorldCom (now part of Verizon)

Total Shareholder Losses: -$102B

Oh, WorldCom. The company that made Enron look like a mom-and-pop shop. WorldCom’s accounting fraud was the largest in U.S. history, and it managed to destroy over $100 billion in shareholder value before filing for bankruptcy. Bernie Ebbers, the company’s co-founder and CEO, went to prison, and the company’s assets were eventually absorbed by Verizon. So, in a way, WorldCom lives on, but not in a way that’s particularly satisfying for the people who lost all that money.

2. Rivian Automotive

Total Shareholder Losses: -$92B

Rivian is an electric vehicle startup that went public in 2021, and it’s already managed to destroy nearly $100 billion in shareholder value. That’s impressive, in a perverse sort of way. The company has ambitious plans to take on Tesla, but so far, it’s mostly taken on a lot of losses.

3. Viavi Solutions

Total Shareholder Losses: -$87B

Viavi Solutions, a company that specializes in network test, monitoring, and assurance technology, is one of those companies that you might not have heard of unless you work in IT. But it managed to lose $87 billion, so clearly, it left a mark.

4. Lucent Technologies (now part of Nokia)

Total Shareholder Losses: -$85B

Lucent was once the crown jewel of AT&T’s Bell Labs, the place where some of the most important innovations in telecommunications were developed. But after being spun off from AT&T in 1996, Lucent struggled to find its footing, and eventually, its assets were absorbed by Nokia. Another case of a once-great company fading into obscurity, taking billions of dollars with it.

5. Wachovia (now part of Wells Fargo)

Total Shareholder Losses: -$68B

Wachovia was a major player in the banking world until the 2008 financial crisis, when it was brought to its knees by bad loans and a collapsing housing market. Wells Fargo swooped in to buy the company in a fire sale, but not before Wachovia managed to destroy $68 billion in shareholder value.

6. DuPont

Total Shareholder Losses: -$60B

DuPont is one of those companies that’s been around forever and has invented some of the most important materials of the 20th century—nylon, Teflon, Kevlar, you name it. But it also managed to lose $60 billion for its shareholders, proving that even the most innovative companies can find themselves in trouble.

7. DaimlerChrysler (now part of Mercedes Benz and Stellantis)

Total Shareholder Losses: -$60B

Daimler-Benz co-founder Carl Benz invented the first practical internal combustion engine car, but that didn’t prevent DaimlerChrysler from losing $60 billion. The ill-fated merger between Daimler and Chrysler in 1998 was a disaster, and the two companies eventually parted ways. Chrysler is now part of Stellantis, and Daimler is back to being Mercedes-Benz, but the scars of that merger are still felt.

8. Qwest Communications International

Total Shareholder Losses: -$59B

Qwest was once a major player in the world of landline telephone and internet services, but it was eventually acquired by CenturyLink after losing $59 billion in shareholder value. The company’s assets live on, but its name does not.

9. Coupang

Total Shareholder Losses: -$55B

Coupang is a South Korean e-commerce company that went public in 2021, and it’s already managed to lose $55 billion. Like Rivian, Coupang has big plans for the future, but so far, those plans haven’t translated into profits.

10. Nortel Networks (now part of Ciena, Ericsson, and Hitachi)

Total Shareholder Losses: -$54B

Nortel was once a telecommunications giant, but it filed for bankruptcy in 2009 after losing $54 billion in shareholder value. Its assets were eventually split up among Ciena, Ericsson, and Hitachi. Like so many companies on this list, Nortel’s name is gone, but its assets live on.

11. Deutsche Bank

Total Shareholder Losses: -$47B

Deutsche Bank is still around, but it’s lost $47 billion for its shareholders over the years. The bank has been embroiled in scandal after scandal, from money laundering to tax evasion, and it’s safe to say that its shareholders have not had a fun time.

12. Coinbase

Total Shareholder Losses: -$45B

Coinbase is one of the biggest cryptocurrency exchanges in the world, but it’s also lost $45 billion in shareholder value. The crypto market is notoriously volatile, and Coinbase has been caught in the crosswinds.

13. Sprint Nextel (now part of T-Mobile)

Total Shareholder Losses: -$40B

Sprint and Nextel merged in 2005 to create Sprint Nextel, but the merger was a disaster, and Sprint was eventually acquired by T-Mobile. The combined company is doing better, but Sprint’s shareholders are still licking their wounds.

14. Broadwing (now part of Lumen)

Total Shareholder Losses: -$38B

Broadwing provided data, voice, and internet services before being acquired by Level 3 Communications, which is now part of Lumen. Like so many companies on this list, Broadwing was eventually absorbed by a larger company after losing billions.

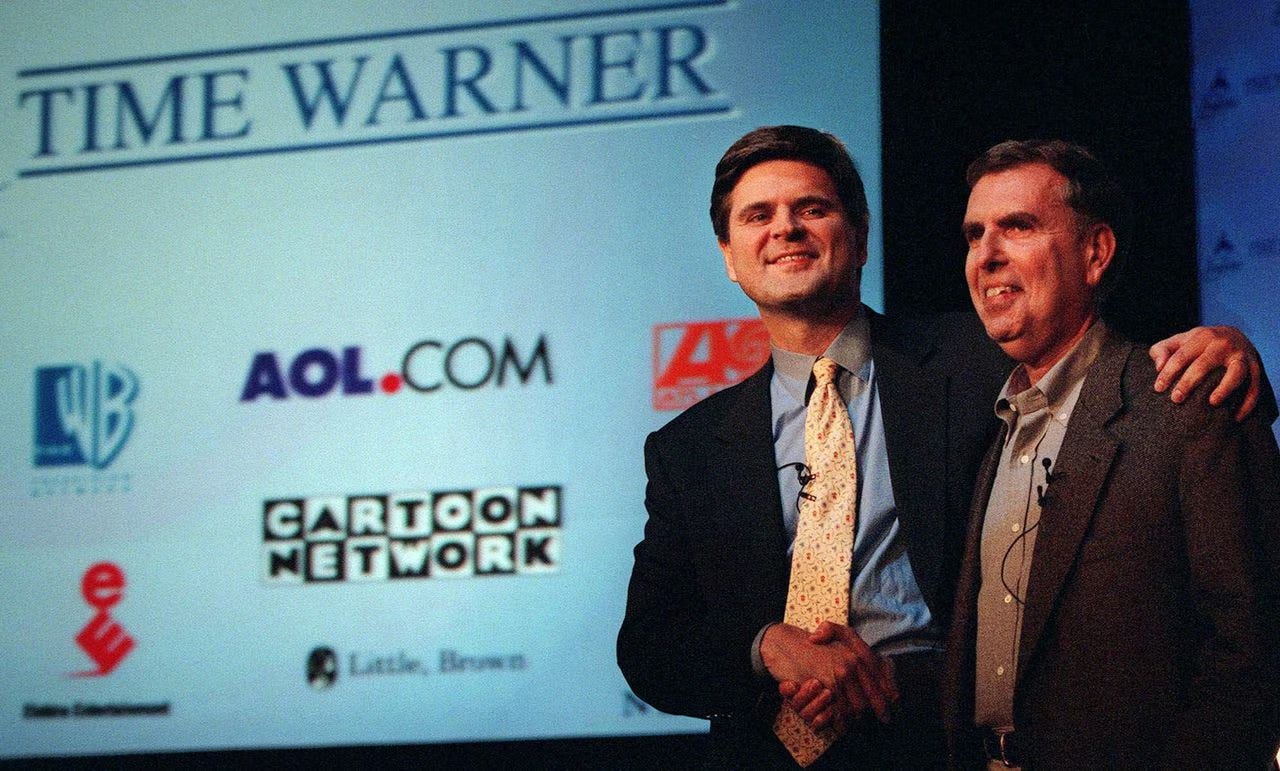

15. Time Warner (now part of Warner Brothers Discovery and Charter)

Total Shareholder Losses: -$37B

Time Warner’s ill-fated merger with AOL in 2000 is one of the most infamous deals in corporate history. The company lost $37 billion in shareholder value, and its assets were eventually split up between Warner Brothers Discovery and Charter.

16. Kraft Heinz

Total Shareholder Losses: -$35B

Berkshire partnered with Brazilian private equity firm 3G Capital, led by Jorge Paulo Lemann, to acquire Heinz in 2013 for $28B. Heinz then merged with Kraft Foods in 2015 to become Kraft Heinz.

17. ArcelorMittal S.A.

Total Shareholder Losses: -$35B

Executive chair Lakshmi Mittal is the 99th richest person in the world, with a net worth of $18B.

ArcelorMittal is the world’s largest steel producer, but it’s also lost $35 billion in shareholder value. The company is still around, and its executive chair, Lakshmi Mittal, is still one of the richest people in the world, but that doesn’t change the fact that its shareholders have taken a beating.

18. Palm (now part of HP)

Total Shareholder Losses: -$34B

Palm was once the king of personal digital assistants and early smartphones, but it eventually faded into obscurity and was acquired by HP after losing $34 billion in shareholder value. Its name is gone, but its legacy lives on in the devices we use today.

19. Uber

Total Shareholder Losses: -$34B

Uber is one of the most famous startups in the world, but it’s also one of the biggest money-losers. The company has lost $34 billion in shareholder value, and while it’s still around, it’s safe to say that its investors haven’t had an easy time.

20. Global Crossing (now part of Lumen)

Total Shareholder Losses: -$33B

Global Crossing was a telecommunications company that filed for bankruptcy in 2002 after losing $33 billion in shareholder value. Its assets were eventually acquired by Lumen, but the company’s name is long gone.

21. DoorDash

Total Shareholder Losses: -$32B

DoorDash is one of the leading food delivery apps, but it’s also lost $32 billion in shareholder value. The company is still around, but like many of the companies on this list, it’s struggling to turn a profit.

22. Paramount

Total Shareholder Losses: -$30B

Paramount Pictures is one of the major American film studios, but it’s lost $30 billion in shareholder value over the years. The company is still around, but its shareholders have had a rough time.

23. Snowflake

Total Shareholder Losses: -$30B

Snowflake is a cloud data storage company that went public in 2020, and it’s already managed to lose $30 billion in shareholder value. The company is still growing, but it’s been a tough ride for investors.

24. Sycamore Networks

Total Shareholder Losses: -$29B

Sycamore Networks was a telecommunications equipment company that was eventually acquired by Marlin Equity Partners after losing $29 billion in shareholder value. Another case of a company that couldn’t quite make it work.

25. Airbnb

Total Shareholder Losses: -$27B

Airbnb revolutionized the travel industry, but it’s also lost $27 billion in shareholder value. The company is still around, and it’s still growing, but like many of the companies on this list, it’s struggled to turn a profit.

Conclusion

So, what do we take away from all of this? Well, for one thing, it’s clear that even the biggest, most innovative companies can struggle. Whether it’s accounting fraud, bad mergers, or just plain old bad luck, there are plenty of ways for a company to lose billions of dollars. But the assets—those live on. Even when a company goes bankrupt or gets absorbed by a larger rival, its assets continue to exist, doing whatever it is that assets do. So, while shareholders might lose everything, the assets persevere, like a phoenix rising from the ashes. Sort of.