Why All Professional Investment Strategies Should Have a Short Component

You don't want compounding to work against you

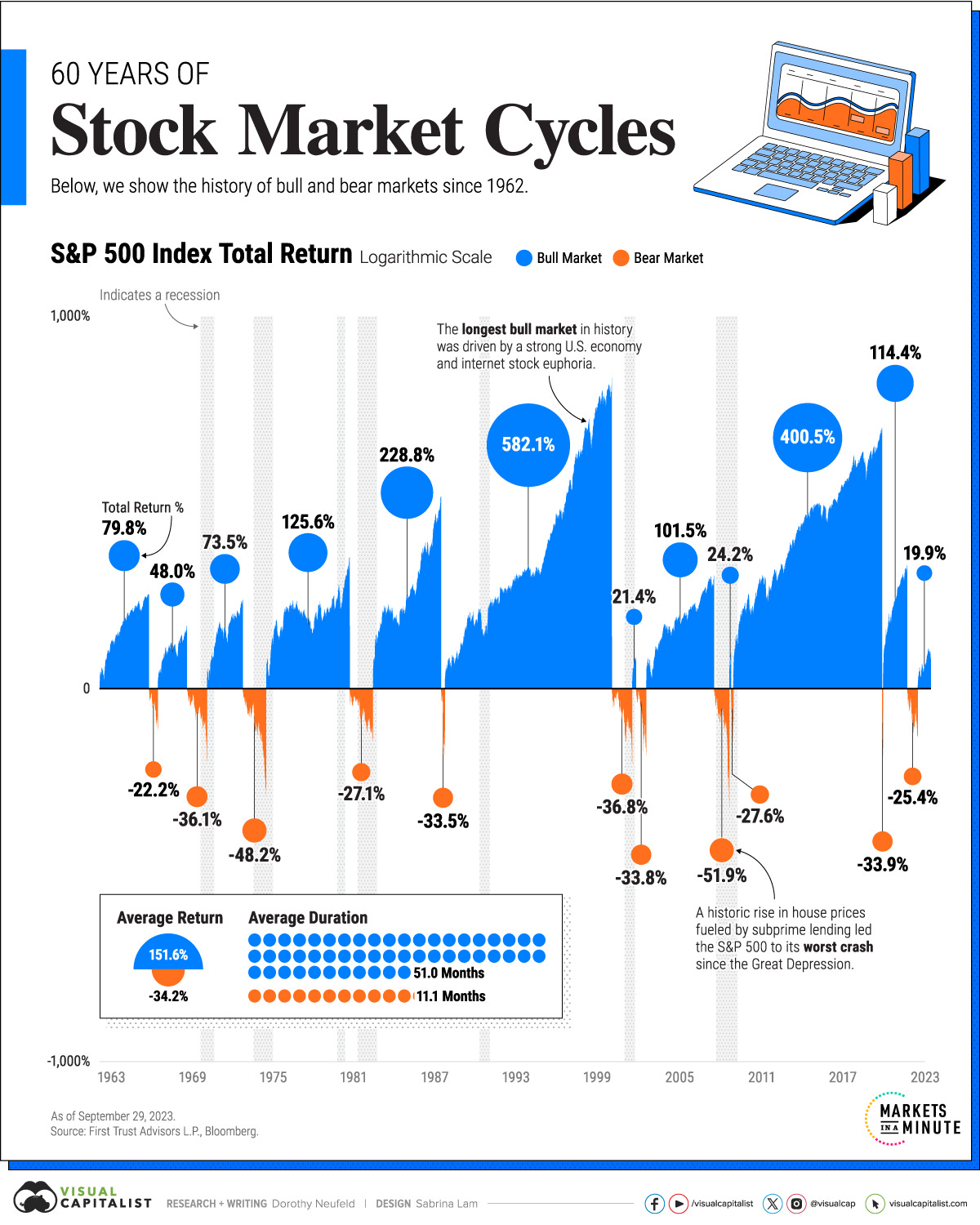

So, you’ve been told to buy and hold, right? Just pick some nice long-term investments, sit back, relax, and in 30 years, you’ll be sipping piña coladas on a beach somewhere. It’s the dream. And, sure, markets generally go up over time — we can all agree on that. But there’s a teeny-tiny problem: They don’t always go up. In fact, they go down quite a bit too. It turns out that up to 20% of the time, markets are in bear territory—you know, that place where your portfolio goes to get eaten alive.

Bear Markets: A Not-So-Fun Fact

Let’s start with some cold, hard history. If you’ve been investing for five years, congrats! You’ve likely spent one of those years in a bear market, watching your portfolio slowly deflate like a sad birthday balloon. The "buy-and-hold" crowd says, "Don’t worry, it’ll recover!" And yeah, sure, it will—eventually.

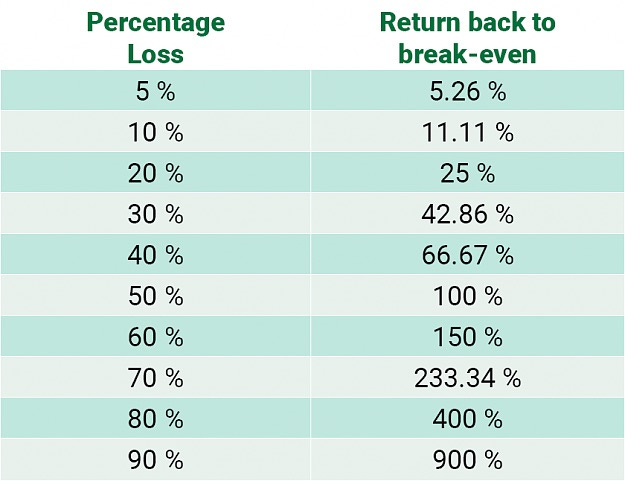

The Math of Loss: It’s Worse Than You Think

Here’s the thing about losses: they’re sneaky.

When you lose 20%, it’s not enough to just make 20% back to break even. You need 25%.

A 30% loss? You’ll need a 43% return.

Lose 50%, and you need to double your money just to get back to where you started.

And heaven help you if you lose 75%—you’ll need a 300% return to recover.

That’s the kind of math that makes you question all your life choices.

Example 1: The S&P 500’s Rough Days

Since 1962, the S&P 500 has had some pretty brutal drawdowns—up to 52% in 2008-2009. You would need a 108% return just to get back to even1. Imagine losing half your money, then having to double it to break even. You don’t need to be a quant to know that’s not fun.

Example 2: Japan’s Nikkei 225 — A Horror Story

Then there’s Japan’s Nikkei 225, which dropped a staggering 80% in the 1990s. You’d need a 400% return just to get your original money back. That’s not investing; that’s waiting for a miracle2.

Compounding: The Reverse Version

You’ve probably heard about the magic of compounding — the way your money grows exponentially over time. But what no one tells you is that during bear markets, compounding works against you. Instead of snowballing into a bigger pile of money, your losses compound downward, especially if you’re pulling money out, say, for retirement. Every withdrawal during a downturn means selling more shares at lower prices, which is basically like eating your seed corn.

Beyond Buy and Hold: There’s More to Life Than Waiting

"Buy and hold" is great and all, but it’s not a panacea. The market may rise over the long term, but when you’re stuck in a nasty drawdown, a few things happen that no one really talks about:

Psychological Freak-Outs: Watching 30% of your portfolio vanish is not conducive to calm, rational thinking. People panic and sell at the worst possible times because, well, they’re human.

Time: Recovery from major losses can take years. The Nikkei 225 took decades to recover.

Opportunity Cost: While your money languishes in a bear market, it’s not doing anything else. You’re missing out on potential gains elsewhere, or even just better uses for that capital.

Warning: Short Selling is Not for the Faint of Heart

Now, let’s talk about short selling. It sounds like the perfect solution to all of this, right? When markets go down, you make money. Easy peasy. Except, no. Short selling can be like playing with fire. It’s for the pros, the folks who spend their days glued to screens, poring over market data, looking for trends, and generally living in a permanent state of stress. If you’re not one of those people, maybe stick to index funds.

Here’s why: bear market rallies are real and vicious. You think the market is going to keep tanking, and then suddenly, it pops back up, and your short position is toast. Not fun.

But If You’re a Pro and You Want to Short...

Done right, a short component can actually help you in a few ways:

Protection: Shorting can act as a hedge, so when your long positions are getting clobbered, your shorts are making money. It’s like having an umbrella in a storm — you’re still wet, but at least you’re not soaked.

Profit: If you time it right, you can actually make money as the market falls. This is the part everyone likes to talk about, but it’s also the part that’s hardest to pull off.

Faster Recovery: If your short positions limit your losses, you don’t need to make as much money on the way back up to recover. It’s the difference between needing a 50% gain versus needing a 100% gain.

Short Strategy Implementation Options

There are a few ways to incorporate short positions into your portfolio, depending on how much of your sanity you’re willing to sacrifice:

Direct Short Selling: You borrow shares and sell them, hoping to buy them back cheaper later. This is risky, requires a margin account, and needs constant attention.

Inverse ETFs: These are easier for retail investors. They go up when the market goes down, but they have quirks like daily rebalancing that can mess with long-term returns.

Put Options: These give you the right to sell at a set price. The risk is defined, but time decay can eat away at your gains if the market doesn’t move fast enough.

Market-Neutral Strategies: These involve balancing long and short positions to reduce exposure to overall market movements. They’re complex and often require professional management, but they can help smooth out volatility.

Risk Management: The Buzzkill You Need

Don’t get cocky. Implementing a short strategy without proper risk management is like driving without brakes; it might be fun for a while, but it won’t end well. Here’s what you need to keep in mind:

Position Sizing: Don’t go all-in on any one short. Keep your exposure limited and spread it around.

Stop-Loss Discipline: Know when to get out. Set exit points and stick to them.

Diversification: Don’t just bet against one sector. Spread your shorts across industries, market caps, and geographies.

Case Studies: The Good, the Bad, and the Ugly

1. The 2008 Financial Crisis

The global financial crisis demonstrated how quickly market conditions can deteriorate. The S&P 500's 52% drawdown devastated many traditional portfolios, while investors with short exposure were able to offset losses or even profit during the downturn. The most famous example was profiled by Michael Lewis’ The Big Short, where a set of maverick investors3 bet against the housing bubble and made out like bandits.

2. The Dot-com Bubble

The technology sector's collapse in 2000-2002 showed how even seemingly unstoppable market segments can experience profound reversals. Investors who maintained short positions in overvalued technology stocks protected their capital and profited from the sector's eventual return to reasonable valuations.

3. The Japanese Experience

The Nikkei 225's collapse serves as a stark reminder that markets can remain depressed for extended periods. The index's 80% drawdown and decades-long recovery period highlights the importance of capital preservation through market cycles.

Conclusion: Don’t Be a Passive Victim

Bear markets happen. They’re painful, and they last longer than anyone wants. Ignoring them and hoping for the best isn’t a strategy. The math of losses is brutal, and the road to recovery is long. If you’re not preparing for the bad times, you’re not really preparing at all. Shorting can be part of a larger, more resilient plan—but only if you do it carefully.

Successful investing isn’t just about riding the bull markets. It’s about surviving the bears too. In an environment where markets can spend years in decline and recovery periods can span decades, the ability to profit from falling markets is not merely advantageous; it is essential for long-term investment success.

The World’s Largest SWF Has Added a Short Component (March 2025)

Long opposed to hedge funds due to high fees, even Norway's giant $1.7 trillion sovereign wealth fund has decided it needs a short component in its portfolio.

Norway’s $1.8tn sovereign wealth fund has made its first investment with an external hedge fund betting on rising and falling stock prices, and plans to allocate billions of dollars more to this strategy as it tries to boost returns. […]

NBIM’s move comes as some investors grow increasingly concerned that equity market valuations look stretched and that simply owning a long-only portfolio of stocks may no longer be the best way to make money from markets.

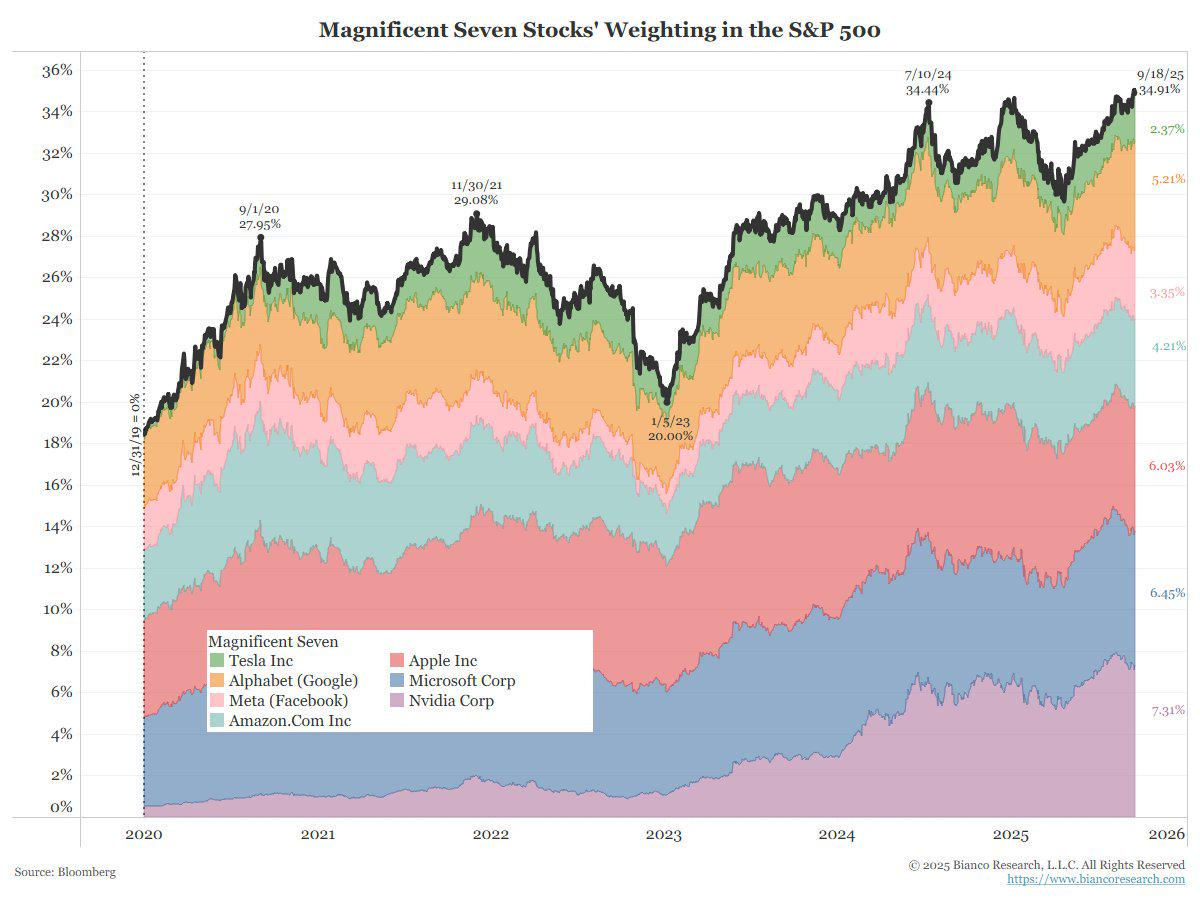

The Index is 36% Tech, For Better or Worse (Nov 2025)

One big issue today with indexing, along with all the risks mentioned above, is that 36% of the S&P 500 is now technology, and nearly all of that is the Magnificent 7. This concentration is being powered by a tidal wave of investor optimism over AI, which some people are calling a bubble.

When you buy an S&P 500 index fund today, more than one-third of your money is going into a bet that the AI party will continue. When this party eventually ends, and it will (parties always do), the multiples for all these companies will compress. That will drag the entire index down. Your safe, “boring” index fund will not provide much protection from the fallout.

This is another, perhaps a more 2025, reason why a purely long-only strategy can be a bit naive. If your main diversification tool, the index itself, is concentrated, then you are exposed. An integral part of an investment strategy must therefore be the ability to short; you need a way to bet against the very thing everyone else is betting on, if only to save yourself when the consensus turns out to be wrong.

About

Inverteum Limited (HK) is a trading firm that specializes in long-short algorithmic strategies to generate returns in both bull and bear markets.

We have generated 52% annualized returns (39% after fees) since inception.

How We Invest

Minimize allocation to individual stocks due to their unpredictability

Build the most suitable trading strategy and go all in. Here’s an example.

Be prepared for bear markets and ensure profitability during bad times by implement a short selling component to the strategy

The S&P 500 surpassed its 2007 high in 2013—6 years to breakeven if you bought at the high.

The miracle eventually came, 35 years later in 2024, when the Nikkei finally surpassed its 1989 high. By then, I’m sure everyone who held stocks in 1989 had sold out, so the profits went to someone else.

Unfortunately, The Big Short investors (Michael Burry, Kyle Bass) kept trying to look for bubbles to short and have not enjoyed good investment results ever since their remarkable trades during the 2008 Financial Crisis, but that is for another post.