158,022% Returns? The Algorithm That Would've Turned $100k Into $158M (Backtest)

Why Algo Trading is the Best Form of Investing

This post is for informational purposes only and does not constitute investment advice. Do your own research and consult with a financial professional before investing.

For the first time, Inverteum is posting a simple algo trading strategy as an introduction to algorithmic trading for those who are unfamiliar. Algo trading (or systematic investing) is where you trade based on a pre-determined set of rules.

Algo Trading Strategy: Triple Accelerator

These are the rules for this Triple Accelerator algo trading strategy:

When the S&P 500 is above its 200-day moving average, go all-in on TQQQ, the 3x levered Nasdaq-100 ETF.

If TQQQ’s 10-day RSI crosses 79 (a.k.a. “overbought”), pivot to UVXY, one of many “fear index” VIX ETFs, to bet on a short term mean reversion in the market.

VIX ETFs can go up a lot when the market becomes fearful and are extremely volatile, but you can lose money quickly if you get the timing wrong.

When the S&P 500 dips below its 200-day moving average, retreat to plain-vanilla SPY to deleverage your portfolio when the market is doing poorly.Backtest Performance

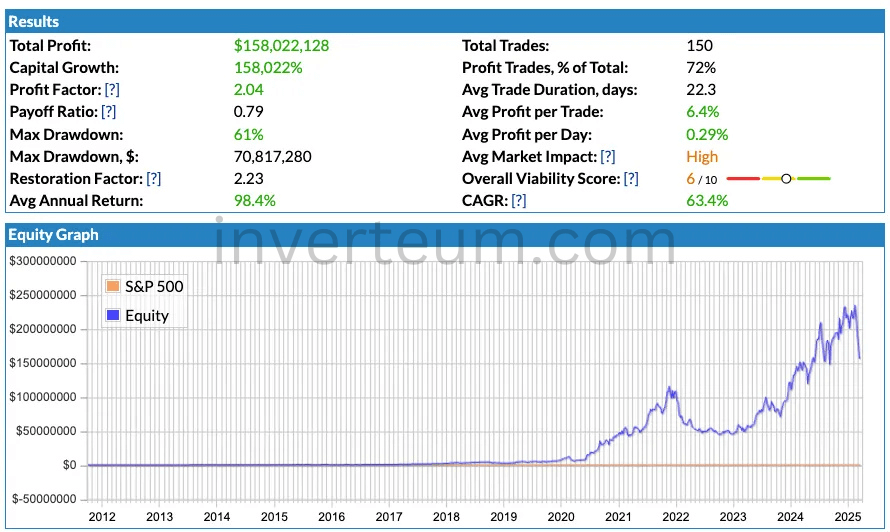

Start date: Oct 4, 2011

Cumulative return: 158,022% over 13.5 years

Annualized return (CAGR): 63%

Max drawdown: 61%

A 61% drawdown requires a strong stomach, and most investors would find it difficult to hold on and keep faith in the strategy. That being said, large market drawdowns have happened throughout history, e.g. S&P 500’s 52% drawdown in 2008-09, Nikkei’s 80% drawdown in the 1990s.

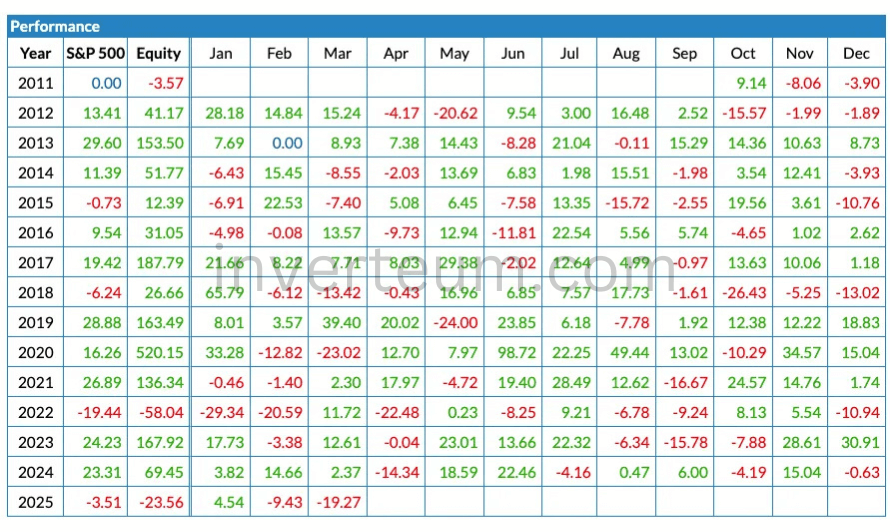

Performance by year and month compared to S&P 500

The Triple Accelerator algo trading strategy significantly beats the market in 12 out of the past 14 years, but at the same time, it is very volatile, with large losses in 2022 and 2025 YTD. Monthly performance ranges from -29% in Jan 2022 to +99% in June 2020.

Triple Accelerator Algo Component Breakdown

1. When the S&P 500 is above its 200-day moving average, go all-in on TQQQ, the 3x levered Nasdaq-100 ETF.

Since October 2011, the algo spends 82% of the time in this logic, and more than half (55.6%) of the total net profit generated came from holding TQQQ.

It's not surprising that the majority of gains come from holding a 3x levered long ETF in a bull market, which is why it’s called the Triple Accelerator.

2. If TQQQ’s 10-day RSI crosses 79 (a.k.a. “overbought”), pivot to UVXY, one of many “fear index” VIX ETFs, to bet on a short term mean reversion in the market.

The algo spends 3% of the time in this logic, but 41.8% of total net profit came from holding UVXY.

When the market becomes overbought in a bull market, there are inevitably corrections where the market reverts to the mean, and those can be big opportunities.

As stated before though, the VIX can be volatile and hard to predict, making this component unquestionably the highest beta—highest risk, highest potential return—part of this algo.

3. When the S&P 500 dips below its 200-day moving average, retreat to plain-vanilla SPY to deleverage your portfolio when the market is doing poorly.

The algo spends 15% of the time in this logic, and it only accounts for 2.6% of total profits.

Unsurprisingly, profits are thinnest (but not nonexistent) in a bear market, in no small part because 1) there is no short component to this algo and 2) SPY is a non-levered ETF, unlike TQQQ.

Disclaimer: Future market conditions will not be the same as the past, so past performance is not an indication of future returns. Don't invest in an algorithm whose mechanics you don't thoroughly understand.

Inverteum has not invested in and does not endorse the Triple Accelerator strategy.

Why Algorithmic Trading is the Best Form of Investing

The Power of Backtesting

For algo trading, your rules for making trades are written down and tested according to historical conditions to see how it would have performed.

With stock picking, those rules are in your head. There is no way to backtest your strategy, e.g. companies with low P/E ratios, and see how it would've performed historically.

Even if you successfully figured out when to buy the stock, it is very difficult to figure out when to sell. Do you hold it forever? It's never clear at the time.

With algo trading, there are clear rules as far as when to buy and sell, making trading much easier. Those rules won't always be right, but at least they are written down and backtested1.

The returns, of course, can be consistently market-beating.

This post is for informational purposes only and does not constitute investment advice. Leveraged index and VIX ETFs are very volatile and risky, and algo trading can lead to significant and permanent loss of capital.

About

Inverteum Limited (HK) is a trading firm that specializes in long-short algorithmic strategies to generate returns in both bull and bear markets.

Inverteum has generated 50%+ annualized returns since inception.

How We Invest

1. Minimize allocation to individual stocks due to their unpredictability

2. Build the most suitable trading strategy and go all in. Here's an example.

3. Be prepared for bear markets and ensure profitability during bad times by implement a short selling component to the strategy

Backtests can be misleading due to overfitting past conditions and are not an end-all-be-all tool. Before deploying any strategy, it’s crucial to understand its components and precisely what conditions do or don't drive returns.

But when used correctly, backtesting is a feature, not a bug, that can be highly informative to your strategy.

I speak from experience because before I discovered algo trading, I picked individual stocks and achieved mediocre returns. Since I've figured out algo trading though, I've consistently outperformed the market.

Is there anything you’d add to this strategy to improve its accuracy?

The "Triple Accelerator" algorithm is an innovative strategy that adjusts investments based on market trends, but it's important to be mindful of the risks involved, including potential drawdowns. While the results are impressive, careful consideration and understanding are key.