The US-China Showdown: A Rivalry for the Ages and a Peek Inside China’s Playbook

Why China will get its way with the West, whether the West likes it or not

Former Assistant Secretary of Defense and author of Destined for War Graham Allison recently called the US-China relationship "the fiercest rivalry history has ever seen".

This isn’t just about trade wars and TikTok bans. This is about two totally different systems going head-to-head. Two fundamentally different ways of thinking about, well, everything.

One system, the American one, is all about the free market. Entrepreneurs do their thing, the market decides if it’s good, and every few years we switch up the political party in charge just to keep things interesting. It’s messy, sure, but it’s also…kind of free-wheeling. Companies and entrepreneurs mostly do what they want, and as long as their activities are legal, the government doesn’t get in their way.

Then there’s China. State capitalism. They’re okay with profits, fine, but the businesses those profits are derived from have to serve the state’s interests. The president’s in charge, and the long-term plan is the long-term plan. Things change only when they decide they need to change.

Munger’s folly

So, Charlie Munger, right? Mr. Value Investor. Warren Buffett’s right hand man. He buys a bunch of Alibaba, like 18% of Daily Journal's portfolio, back in 2021. Pays somewhere between $180 and $200 a share. Seems smart. Alibaba’s huge, dominant in China.

Then… things go south. Fast. He sells half his stake at $116. Ouch. And the rest? Still holding it as of October 2023, at around $85 a share. Down more than 50%. Double ouch.

What happened? Did the Abominable No-Man…whiff?

Well, back in 2021, another Alibaba bull, Tom Hayes, was saying, basically, Alibaba’s a steal. A billion users! #1 e-commerce company in the world’s second largest economy! Moats the size of the Great Wall! Buffett and Munger, geniuses!

And in a normal, free-market, rule-of-law kind of country, he’d have been right. Alibaba looked like a classic value play. Dominant company, growing revenue, stock price down. Textbook.

But China isn’t a normal, free-market, rule-of-law country. In China, entrepreneurs are allowed to succeed to the extent that the state sees their actions as beneficial to the country's greater interest.

Your moat could be filled with crocodiles and dragons, but if Beijing decides your business isn’t in their interest, life will be tough for you.

Was Jack Ma too outspoken? Or did Chinese big tech get too powerful for the Party to tolerate?

The story everyone told was that Jack Ma, Alibaba’s founder, got a little too big for his britches. Criticized the government, maybe got a little arrogant. And Beijing smacked him down. Antitrust, they said. Too much power.

Bloomberg wrote a whole thing about it, how Beijing was cracking down on Big Tech. One trillion and a half wiped out! Wild swings! Drama!

China’s government kicked off a sweeping crackdown on its most powerful corporations a year ago.

The campaign that started with Ma’s twin giants—Ant Group Co. and Alibaba Group Holding Ltd.—last November soon spread to more companies like Tencent Holdings Ltd. and Didi Global Inc., as Beijing stepped up oversight on everything from antitrust to data security and wealth distribution. The crackdown triggered a selloff that, at its most extreme, erased $1.5 trillion from Chinese stocks, which experienced wild swings with every new government probe, rule and warning.

But here’s the thing: China loves monopolies. Just not the wrong kind of monopolies. They’re happy with CATL (batteries), SMIC (chips), Huawei (telecom), DJI (drones). These companies are strategically important. They help China win.

Dan Wang, smart guy, said it best:

I find it bizarre that the world has decided that consumer internet is the highest form of technology. It’s not obvious to me that apps like WeChat, Facebook, or Snap are doing the most important work pushing forward our technologically-accelerating civilization. To me, it’s entirely plausible that Facebook and Tencent might be net-negative for technological developments. The apps they develop offer fun, productivity-dragging distractions; and the companies pull smart kids from R&D-intensive fields like materials science or semiconductor manufacturing, into ad optimization and game development.

China doesn’t want its best and brightest building the next WeChat. They want them building things that matter, things that give China an edge. And they’re willing to pay for it. Salaries in EVs and batteries are holding up. Finance and internet? Not so much, cut in half from before.

The importance of industrial monopolies to Beijing

China wants to be TSMC1, but a hundred times bigger. They want to be the source for everything the world needs. Chips, solar panels, batteries. You name it. Because if everyone needs you, you have leverage. Real leverage.

As the world’s foremost and largest manufacturing cluster, i.e. the factory of the world, China’s primary comparative advantage is hardware, and what Beijing most wants are industrial monopolies like TSMC.

1) Solar

Take solar. It’s cheap, it’s clean, it’s the future.

Today, solar + batteries ($46-102/MWh) is either cheaper than or cost competitive with other baseload sources of energy, including natural gas ($39-101/MWh)—the top electricity source in the US.

Through being able to provide power around the clock, solar + batteries enable a complete replacement of fossil fuels, particularly in the sunniest parts of the world, including the United States, Southern Europe, and Central and South Asia.

Unsurprisingly then, solar has been the fastest growing source of electricity since 2016, and when it comes to new power plant construction, batteries have surpassed natural gas.

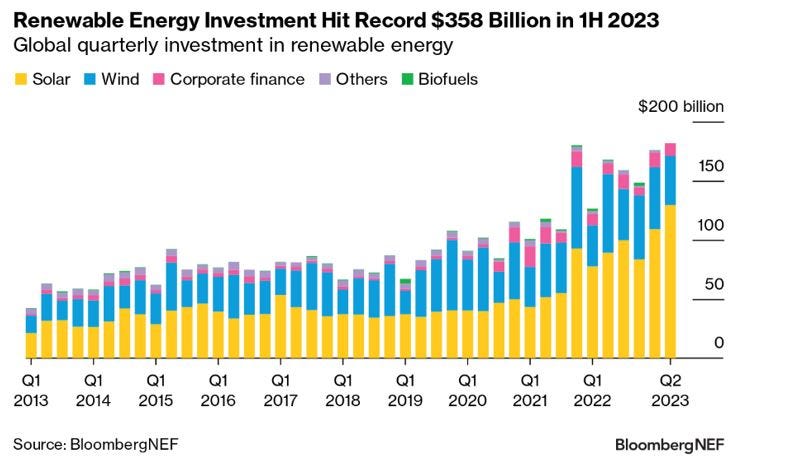

Two-thirds of all investment in renewable energy is solar—2x all other renewables combined.

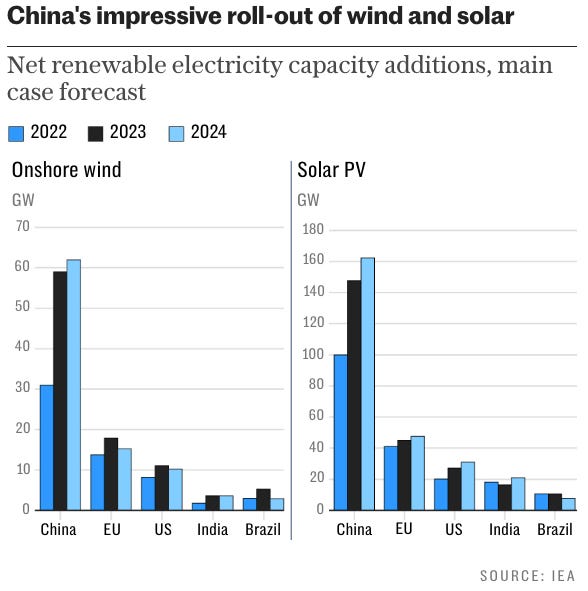

Guess who makes most of the world’s solar panels? China.

Like, 70-90% of everything. The West wants to go green? They need China.

2) Batteries + EVs

Same with batteries and EVs.

China has majority share (up to 80%) in most material processing and manufacturing of battery cell components, battery cells, and EVs.

With bans on fossil fuel vehicles set to go in effect as early as 2030, the world’s going electric, and China controls the supply chain.

They’re like OPEC, but on steroids. China's share of solar and battery manufacturing capacity today (60-80%+ for key components) far exceeds OPEC’s share of oil production during the 1970s energy crisis (~50%), which wreaked havoc on the West.

China’s dominance in solar and batteries today, combined with its position as the world’s manufacturing superpower, means that the country has more leverage over the West than OPEC ever did.

Even California, the land of tech and innovation, is going to China for help with fighting climate change. Gavin Newsom, hanging out with Xi Jinping. Because California can build apps, but they can’t build green technology like China can2. America gets the profits, China gets the power. See how this works?

Why is China so far ahead?

Simple: industrial policy. And a huge domestic market.

They saw the future with solar and EVs, and they built it. Cheap loans and land for factories, subsidies for consumers.

Supply

China made it expensive to build gas-guzzlers and cheap to build EVs.

China introduced a dual-credit system for the auto industry in 2017, which awards points for making clean cars and penalties for those with high fuel consumption. Cars from producers with negative scores may be taken off the market. To avoid punishment, manufacturers can buy credits from rivals with positive scores, like Tesla Inc. or BYD. It can get expensive. State-owned Chongqing Changan Automobile Co. lost 4,000 yuan in profit for each car sold in 2020 as it bought credits to avoid the penalty.

Beijing only subsidized EVs “if the battery was made by a Chinese company” to ensure the growth in EVs benefited the country.

Demand

At the same time, Beijing created huge incentives for the Chinese public to switch to EVs.

National subsidies reimbursed EV Buyers with as much as US$8k.

EV sales are not subject to the 10% tax on cars until 2025.

Fossil fuel cars are subject to a license plate lottery or auction while EVs can get a green license plate much more easily.

They built charging stations everywhere, even before anyone needed them. No range anxiety in China!

A vast, mostly unused, EV charging network prevents embarrassments like the US energy secretary’s team using a gas car to block an EV charging port and getting the police called on her staff during their 620-mile (998 km) EV road trip.

Home court advantage

Because China’s so big, they can create their own demand. Globally, more than half of EVs and solar panels are sold and installed in China respectively.

They build the factories, they get the scale, they dominate the global market. It’s a virtuous cycle, if you’re China. Less virtuous if you’re, say, a US automaker.

China's economy hasn't collapsed—it's transforming

Everyone’s talking about China’s real estate woes.

The Chinese saw housing as a much safer investment than stocks and bonds and sought to put nearly all their wealth into housing, believing “the notion that China’s property prices could only go up”.

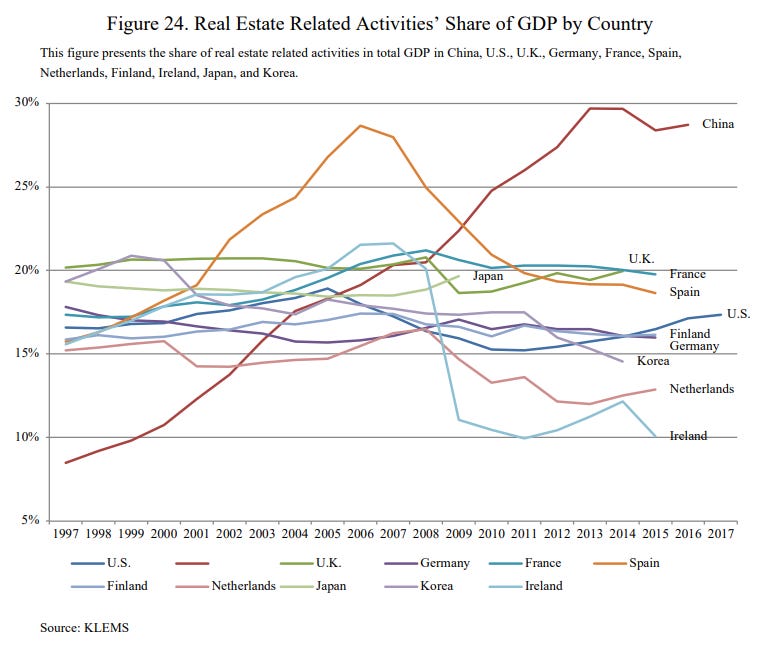

This irrational demand for housing fueled a massive speculative property bubble throughout the country starting in 2008, causing real estate’s share of GDP in China to dwarf other developed economies.

China’s housing became completely unaffordable for the middle and working class.

Towards the late 2010s, Beijing grew increasingly concerned about housing unaffordability. In 2017, President Xi emphasized, “houses are built to be inhabited, not for speculation”. The government unveiled a raft of measures to cool the market.

Today, that housing bubble has finally popped, with the fall of Evergrande and default of Country Garden—two Chinese property giants.

Housing is a mess, sure. But it’s also…kind of the point. China built a housing bubble, and now they’re letting it deflate. Because they’re moving on. They’re…

Shifting to Manufacturing

China is focusing on what matters: manufacturing. They’re doubling down on being the world’s factory3.

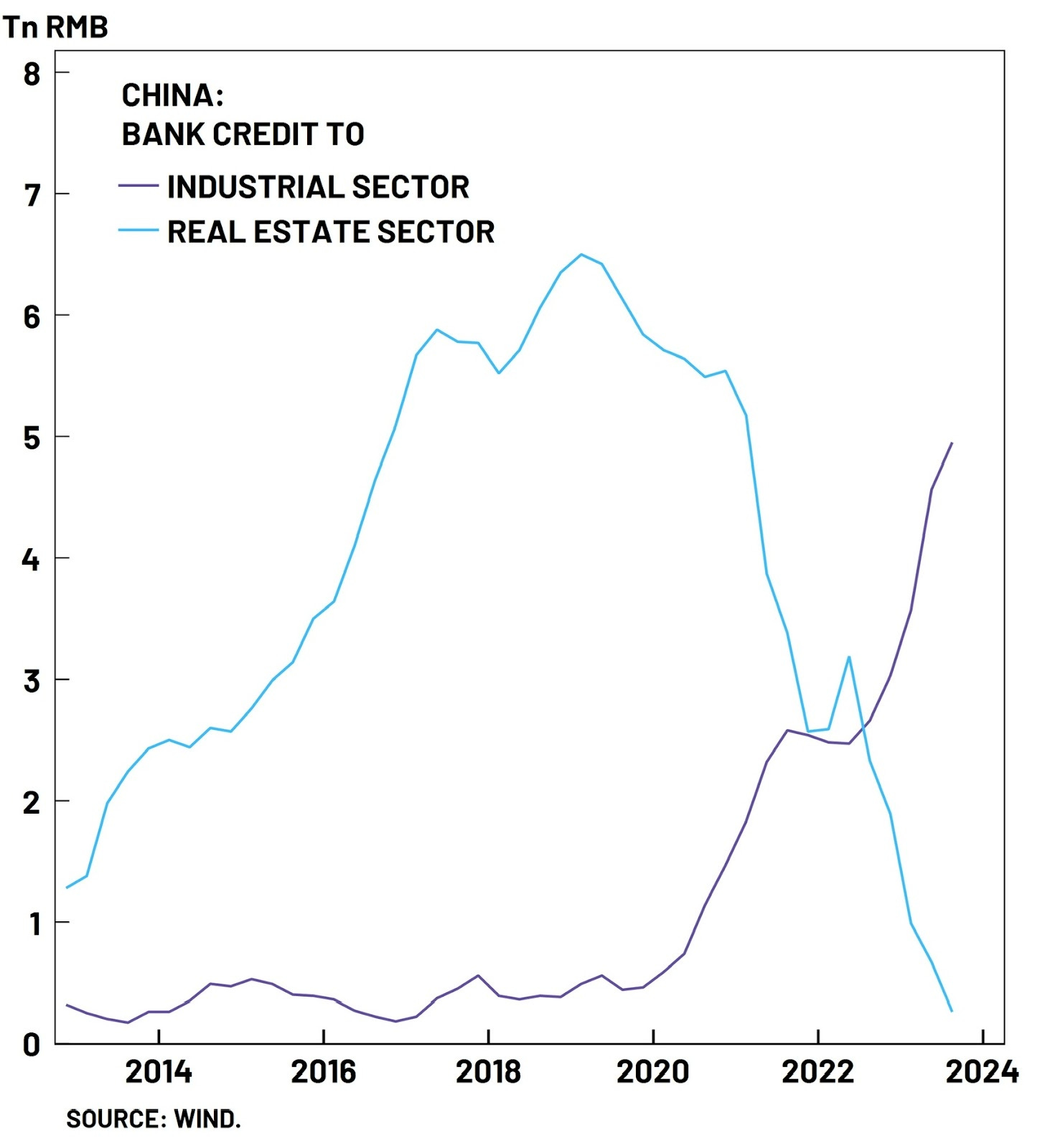

Starting in 2020, Chinese bank loans shifted away from the now struggling property sector and toward manufacturing.

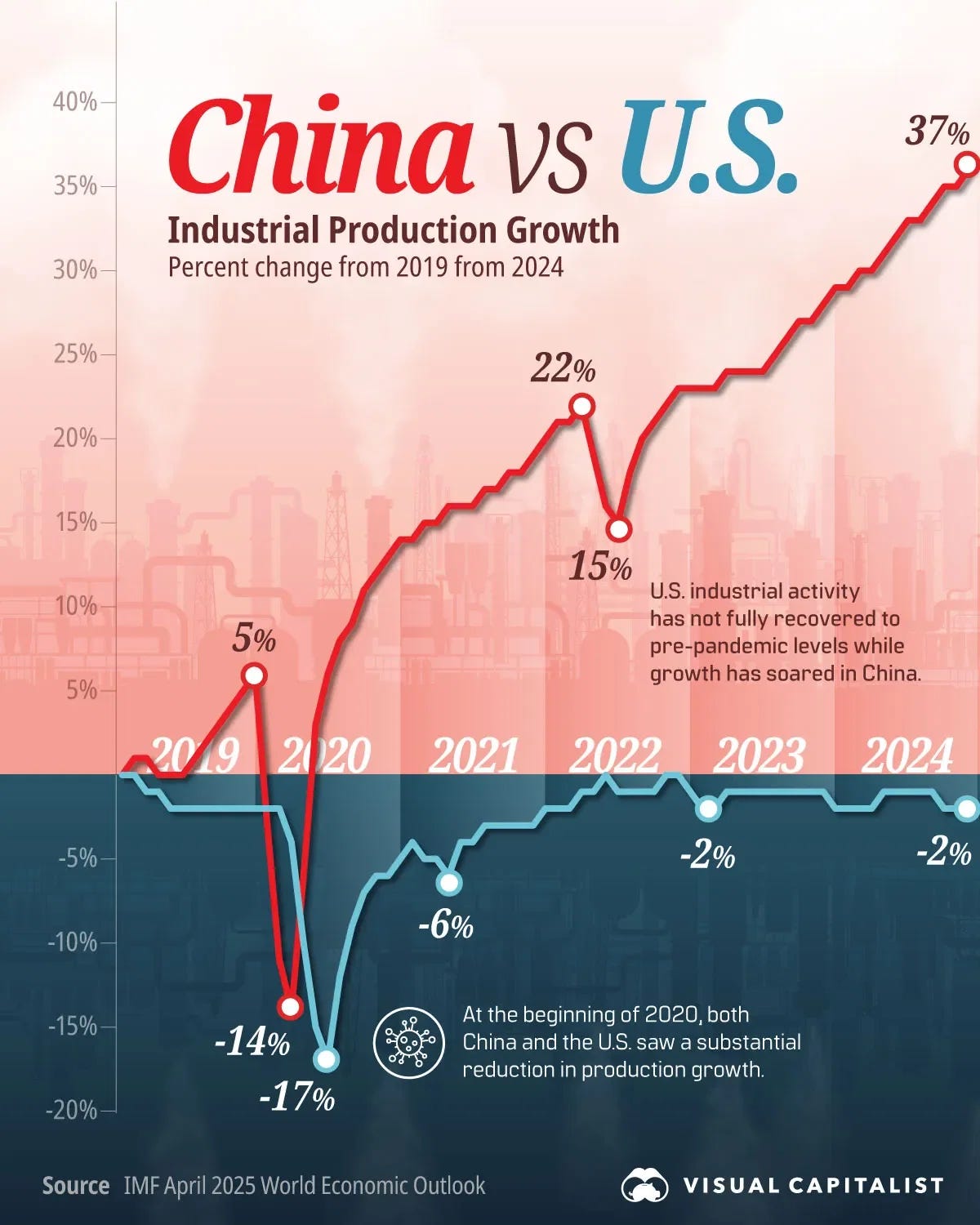

They’re building solar factories, EV factories, battery factories. They’re building everything, and their industrial production has kept growing ever since.

China is the only country in the world with every single industrial category in the United Nations industrial classification. It is the world’s factory, and it fully intends on making even more of the goods the world relies on.4

Beijing’s shift in economic focus has already significantly increased the strength of the two industrial monopolies mentioned earlier.

Solar: 5x growth in solar cell manufacturing since 2018

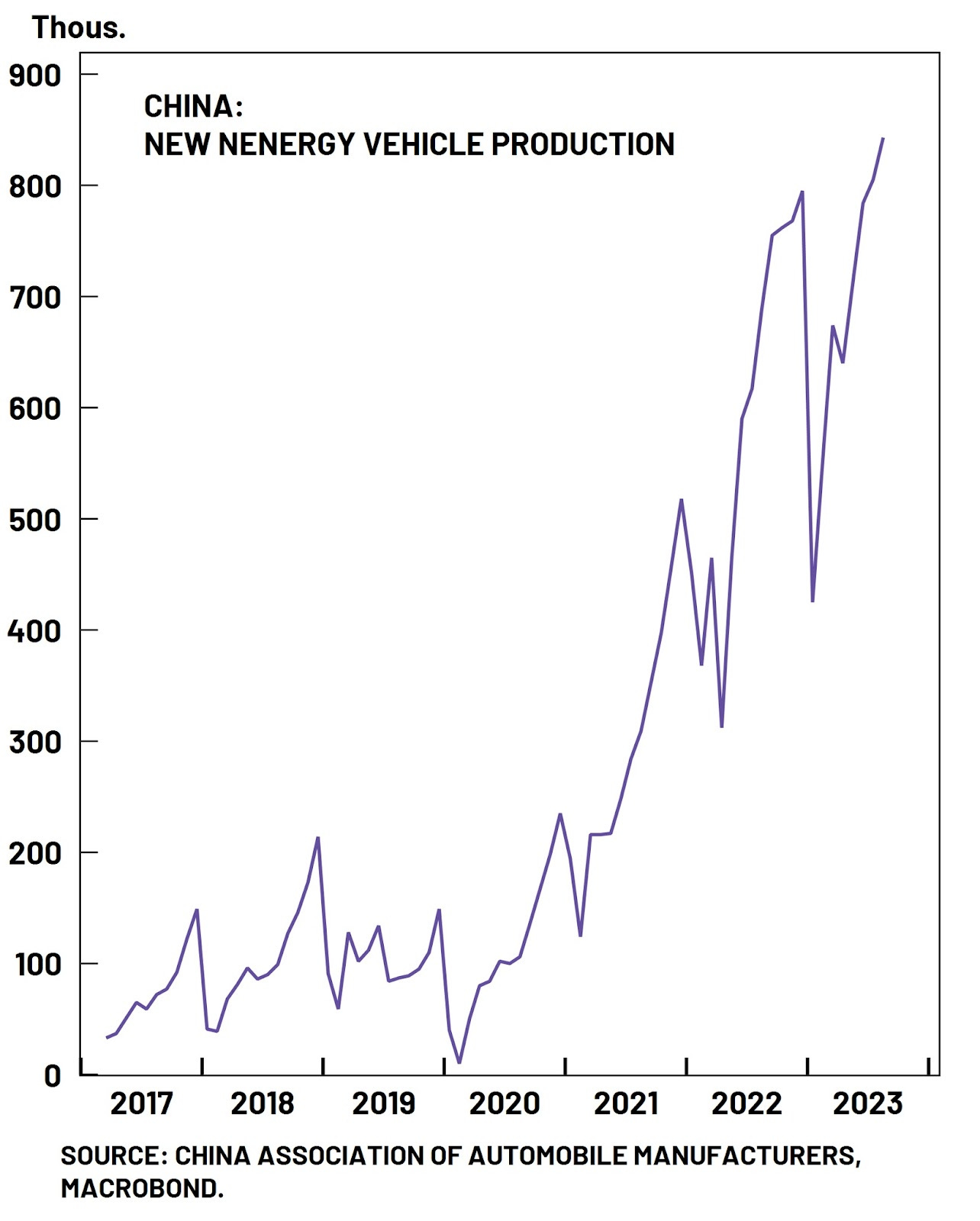

EVs: 8x growth in "new energy vehicles" (i.e. EVs) since 2020

China has already built enough solar panel factories to supply the entire world’s needs. It has built enough auto factories to make every car sold in China, Europe and the United States. And by the end of 2024, China will have built in just five years as many petrochemical factories as all of those now running in Europe plus Japan and South Korea.

This shift in China’s economy from real estate and services to manufacturing will involve a lot of short term pain. Young people don’t want to work in labor intensive jobs in factories, even electing to deliver takeout and goods instead.

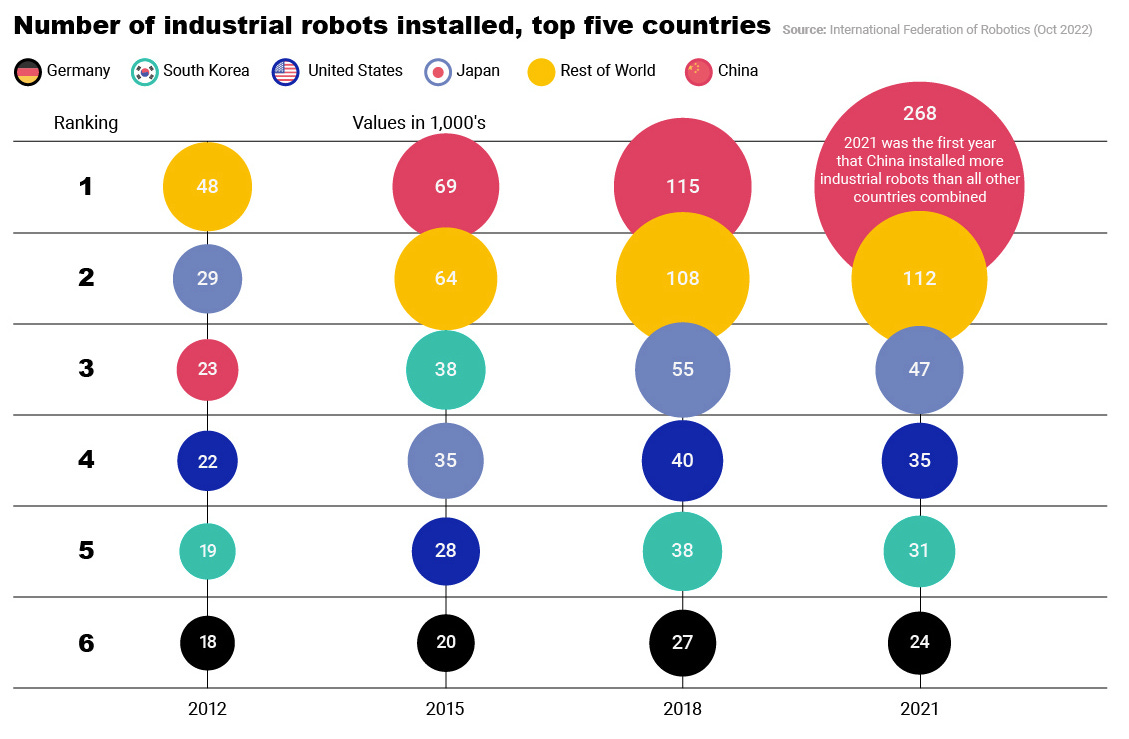

A combination of higher wages and greater automation will likely solve this issue over time. China today already has more industrial robots than the rest of the world combined.

Greater automation allows backbreaking blue collar work to transform into mentally stimulating white collar work, making factory jobs more appealing to young people.

In October 2023, Beijing removed all restrictions on foreign investment in the manufacturing sector. National security? Eh, details. Manufacturing is king.

Capitalism, Beijing-style

China’s not interested in maximizing profits for shareholders. They’re interested in maximizing power for the state. If your company helps them do that, great. If not… good luck.

The harder it is for the West to wean itself off of Chinese products5, the more easily Beijing can assert itself in the future.

They have a name for the companies they want: “category champions” (单项冠军企业). Companies that dominate their niche globally. They have hundreds of them. And they’re building more every day.

“Category champions”

In her 2023 report titled “Little Giants, Single Champions”, Force Distance Times went into detail on “category champions”.

To be considered a “category champion”, a Chinese company must rank in the top 3 companies by global market share in its specific niche.

As of 2023, China has more than 600 “category champions”, more than triple its 2016 goal of 200.

Examples of category champions:

Xi’an LONGi Silicon Materials: 46% global market share in silicon wafers, used in all semiconductor chips.

Shanghai Quectel Wireless Solutions: 38% global market share in cellular modules, necessary for cars, drones, smart factories, robots, and power grids.

GRIPM Advanced Materials: 38% global market share in copper-based metal powders, used for 3D printing.

Even Raytheon, the US defense contractor, can’t find alternatives to some Chinese components. The F-35, America’s top fighter jet, used a Chinese part! Think about that.

US vs. China

The US free market system maximizes 1) wealth for entrepreneurs and investors who most profitably serve the market and 2) tax revenue for the state, in that order.

The Chinese state capitalist system maximizes 1) power for the state and 2) wealth for entrepreneurs and investors who advance the interests of the state, also in that order.

To the Chinese people, Beijing's philosophy is best articulated by John F. Kennedy in his inaugural speech: "Ask not what your country can do for you — ask what you can do for your country."

The US is rich, powerful, globally involved. But China is…focused. They have a plan, a tight collaboration between the public and private sector, and they’re executing it. They’re building the future, whether we like it or not.

The key difference is industrial policy

“The US has an industrial policy. Here’s the policy: We don’t have one,” says Jeff Chamberlain, who spent more than a decade at Argonne National Laboratory trying to commercialize battery tech before starting a venture capital firm in 2016. “I’m not saying we should become socialist or communist, but other countries that have decades-long industrial policies, they’re gonna eat our lunch.”

Due to policy changes from administration to administration, the US has no consistent industrial policy. Unsurprisingly, the country often fails to nurture breakthrough industries in hardware and leaves nascent companies to the whims of the free market.

The US has resources, but China has…strategy. They’re playing the long game. And they’re winning. Because they understand something fundamental: in the 21st century, industrial power is real power. And China is building a lot of it.

The entire world relies on chips made in Taiwan by companies like TSMC for its modern way of life. The island manufactures nine out of 10 of the world’s most advanced chips.

China’s rollout of renewable energy generation capacity exceeds the rest of the world combined and is forecast to grow significantly in the future.

The US-based Center for Global Development predicts China’s share of global manufacturing output could rise to 43.7% in 2050.

The director of China’s top economic planner expects “digital, new energy, advanced manufacturing and biological engineering to be the four areas which can take up the baton from property as ‘pillar industries’.”