Why Hong Kong is the Best Place to Live and Invest From

East Asia is the place to be and Hong Kong is the key

What if we told you there’s a place where safety, infrastructure, quality of life, and international accessibility converge? Where skyscrapers stand as emblems of modernity, high-speed trains whisk you across the most densely populated region in the world, and Michelin-starred restaurants outnumber those in New York City?

Welcome to Hong Kong: a city that’s not only a gateway to East Asia but the ideal place to live and invest from.

East Asia: The Most Livable Region in the World

Let’s start with the big picture. East Asia is, objectively, the best region in the world to live in.

Safety

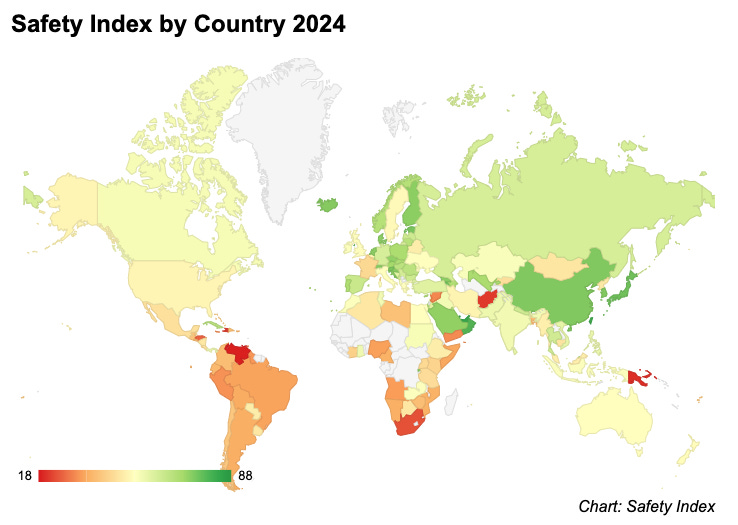

When it comes to public safety, East Asia is practically utopian. Excluding North Korea (an outlier for many reasons), every jurisdiction in the region boasts a Numbeo Safety Index of at least 75—safer than Switzerland (74.7).

Compare that to the U.S., where the safety index is a paltry 51, and you begin to understand how extremely safe and crime-free East Asia is, particularly compared to the rest of the world.

Infrastructure

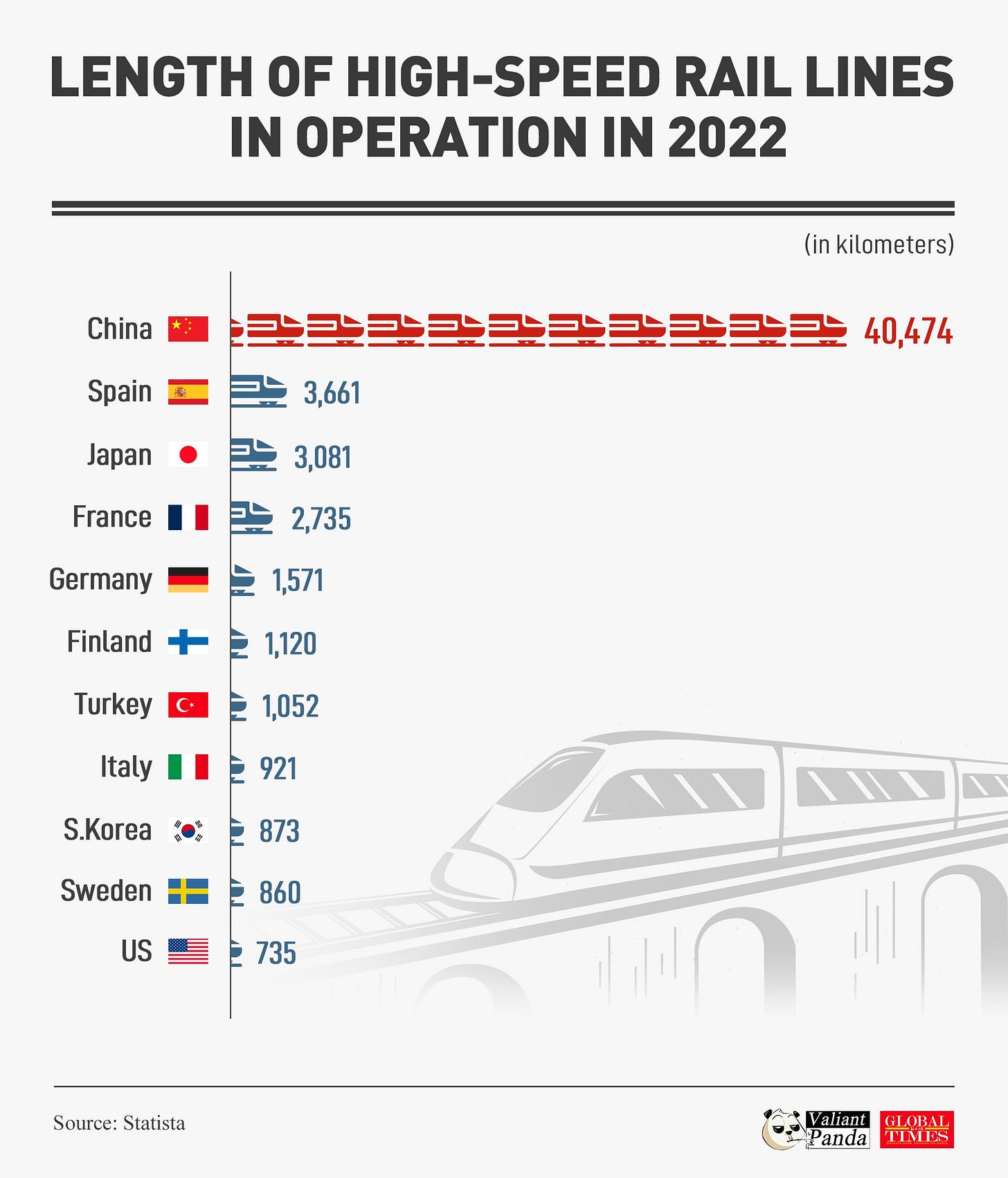

This is the land of high-speed rail and skyline-dominating skyscrapers. East Asia has more of both than the rest of the world combined.

The region is also pioneering drone-powered economies, which sound like science fiction but are becoming reality here.

With excellent infrastructure, gleaming skyscrapers, minimal crime, and drones filling the skies, East Asia is quite literally the futuristic world depicted in the The World If meme.

Economic Prosperity

By purchasing power parity (PPP), East Asia has the highest total GDP of any region globally. If the global economy were divided into 1,000 units of GDP, East Asia would account for 257, outpacing North America (200) and Europe (214).

Why Hong Kong Stands Out

Now that we’ve established the upsides of living in East Asia, let’s narrow it down. Why Hong Kong?

1. Language and Internationalism

Hong Kong is the most international city in East Asia. It’s the only place in the region where English is an official language, widely used in business, legal, and commercial contexts. For global investors, this means no translation necessary and far fewer hurdles navigating contracts, regulations, or tax policies.

2. Investor-Friendly Tax Policies

Hong Kong offers the best tax policy in East Asia for investors. There’s no tax on dividends or capital gains, making it the most attractive jurisdiction for wealth preservation and growth.

For private equity funds, carried interest (performance fees) can even be totally exempt from income tax.

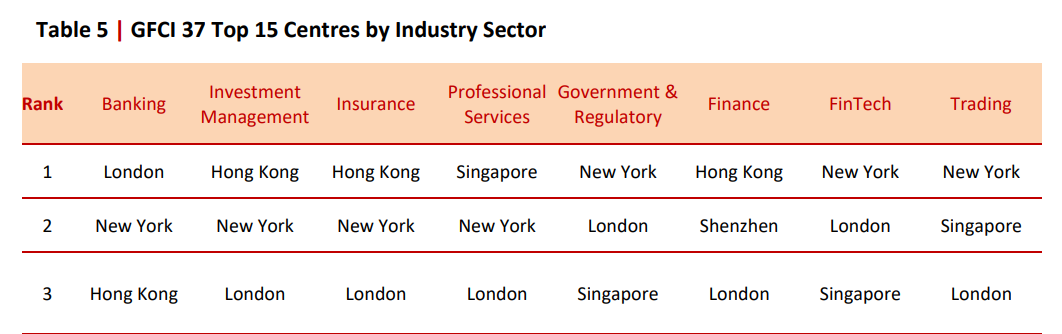

Unsurprisingly, according to the Global Financial Centres Index, HK ranks #1 in the world for Investment Management, above NYC.

3. Globally Trusted Legal System

Businesses worldwide trust Hong Kong’s legal system for dispute resolution. In fact, Hong Kong is the #1 preferred seat for arbitration in East Asia and #3 globally1, after London and Singapore2. Even after the tumultuous democracy protests of 2019, Hong Kong’s global ranking improved from #4 in 20183 to #3 in 2021. That’s a testament to the robustness of its legal and business environment.

4. Access to China

Regardless of their citizenship, permanent residents of Hong Kong and Macao can obtain Mainland Travel Permits to travel to China, even allowing them to use express channels to cross the border.

5. Unparalleled Food Scene

Hong Kong has 78 Michelin-starred restaurants—more than New York City.

After billionaire Larry Ellison bought the Hawaiian island of Lanai, he called the food there “inedible” before importing the luxury Japanese chain Nobu. In Hong Kong, you don’t need to fly in great food; it’s already at your doorstep.

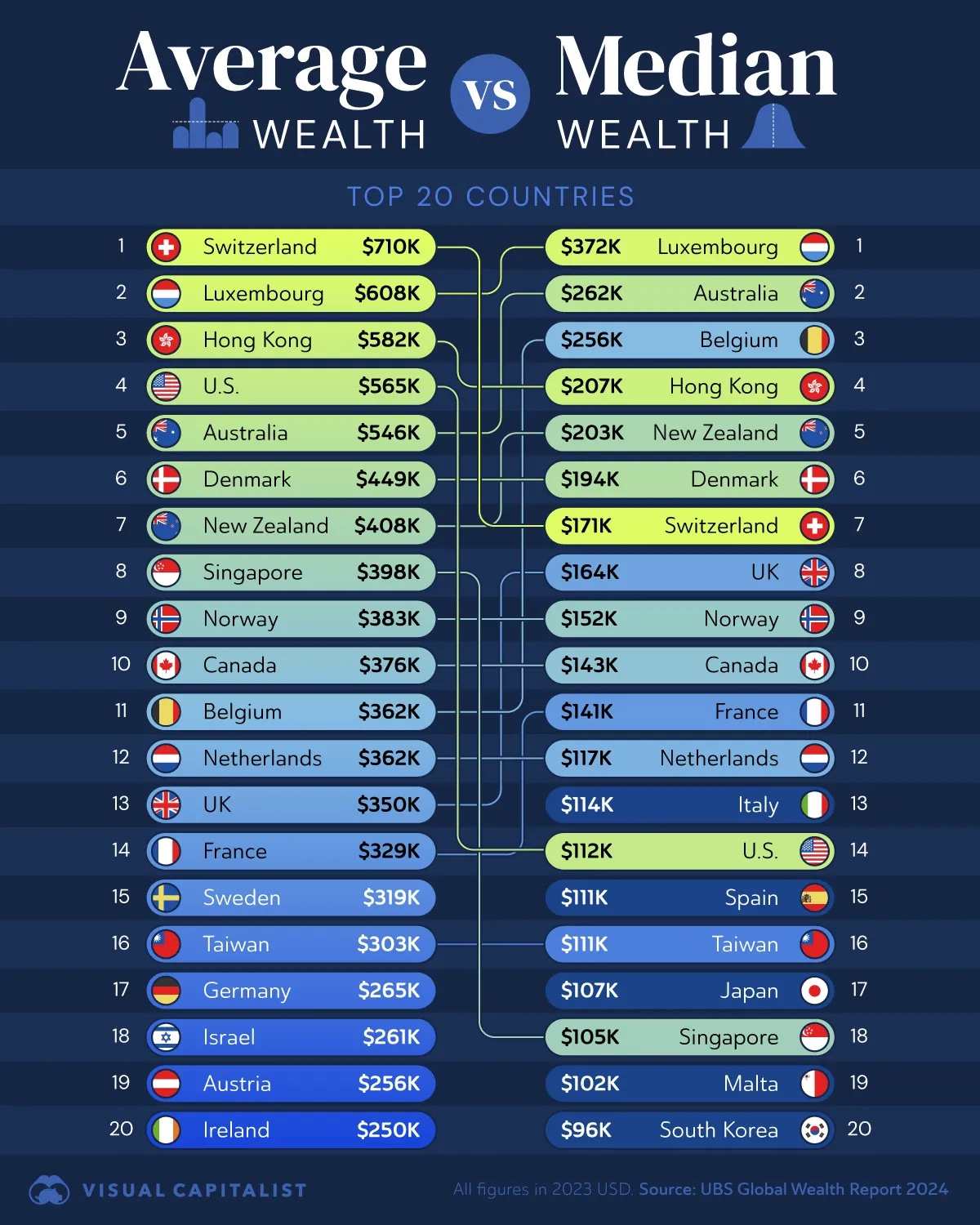

6. Wealth

170+ years of trade and capitalism combined with HK’s position as gateway to the world’s second largest economy have made Hongkongers the wealthiest people in Asia, with double the median wealth of Singaporeans.

The massive prosperity of East Asia compared to Southeast Asia means HKers have access to better opportunities to accumulate wealth compared to Singaporeans.

The 2019 Protests and National Security Law: A Necessary Reset

The unspoken truth that the world ignores and overlooks is that the 2019 Hong Kong protests were the explosion of a time bomb set by the last British governor of HK 25 years earlier, in 1994.

In 1994, just before the 1997 handover, the last British governor of Hong Kong, Chris Patten, introduced democratic reforms that allowed millions of Hong Kong residents to vote for their Legislative Council representatives for the first time.

It was blatant hypocrisy. For 150 years, Britain ruled Hong Kong as a colony without any form of democracy. Introducing democracy three years before handing the territory back to China was Patten’s way of giving Beijing a governance headache that the British themselves never had to contend with.

The father of modern Hong Kong4, Murray MacLehose, criticized Patten

for spoiling the "cooperative relationship" between Britain and China over Hong Kong and added "such mindless political polarisation cannot be in Hong Kong's interest" on 11 March 1994.

MacLehose was right. The partial democracy Patten implemented led to decades of gridlock and ineffective governance. Before resigning en masse in late 2020, the pan-democrat camp in the Legislative Council repeatedly used filibusters to block necessary legislation, stalling the government’s ability to function for several years.

Meanwhile, housing costs soared, apartments shrank to “mosquito flats,” and public discontent grew. Due to the high cost of living, there was a growing sense of hopelessness that no matter how hard you worked, your life wouldn't get any better, and you’d never be able to afford to buy a home and move out of your parents’ place.

In 2019, the time bomb exploded, and frustrated Hong Kongers took to the streets. The NSL and 2021 electoral reform was Beijing’s response to restore stability and government functionality. These measures were controversial, but they’ve started to deliver results.

Since 2019, while the population has grown 0.4%, housing costs have dropped almost 30%, in large part because of the government’s efforts to increase supply of both private and public housing in order to soothe public discontent.

Now, the government is finally able to pass and implement policies that improve the lives of ordinary citizens.

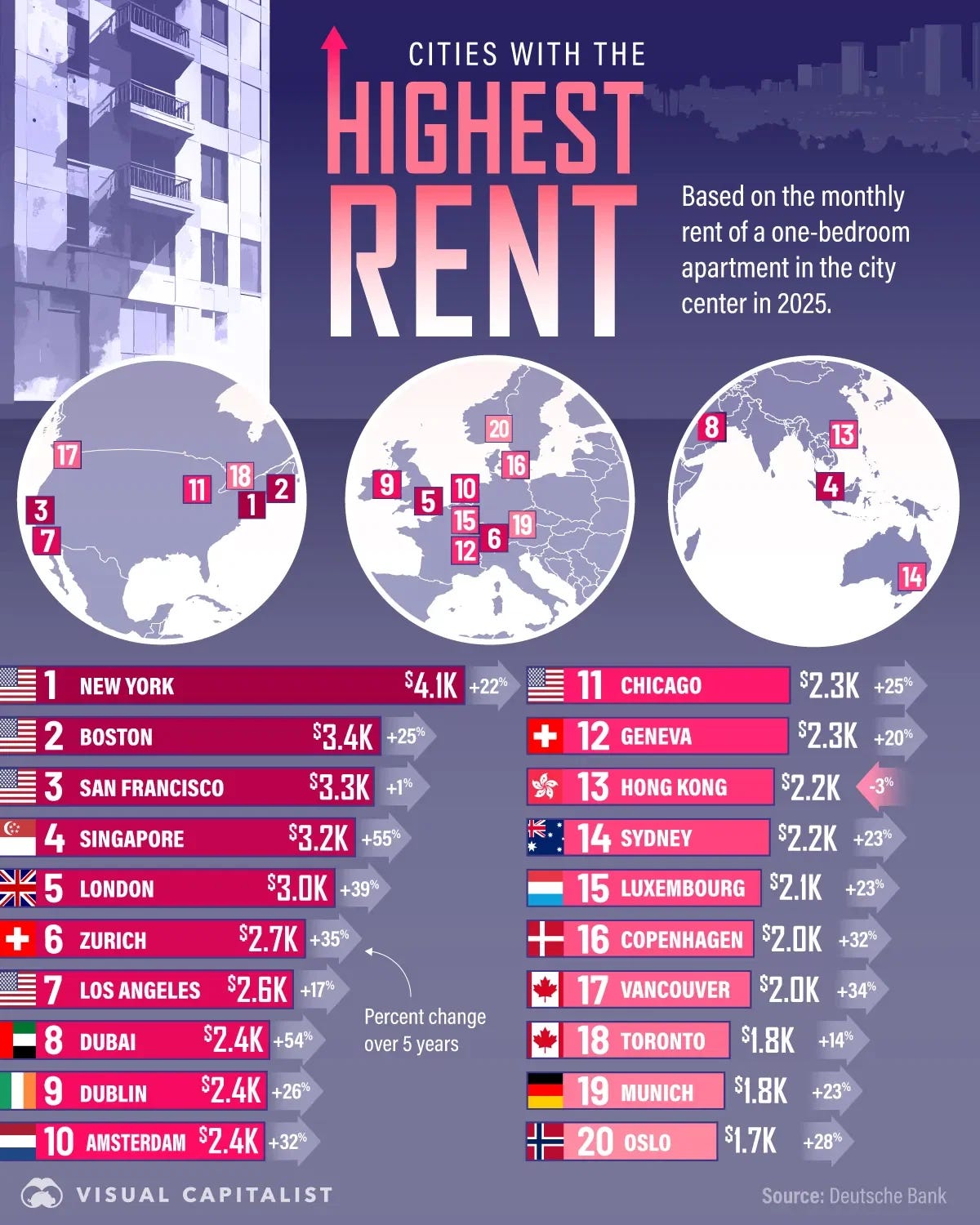

Previously infamous for the world’s highest rents, today, Hong Kong’s rents don’t even crack the top 10 in the world.

One Country, Two Systems Is Alive and Well

Despite Western skepticism, “One Country, Two Systems” isn’t dead. In fact, here’s some of the strongest evidence of Hong Kong’s unique freedoms compared to Mainland China.

1. Visa-Free Travel for Taiwan’s Allies

Taiwan is the ultimate red line5 for Beijing. Yet, citizens of 11 out of the 12 nations that recognize Taiwan as a sovereign country can travel to Hong Kong visa-free.

These are countries whose governments refuse to acknowledge the legitimacy of the People's Republic of China, yet their citizens can freely visit the richest city in China.

2. Uncensored Internet

You can use YouTube, Gmail, Substack, and WhatsApp without a VPN6. This is much more convenient for those coming from the West7.

The global, instant nature of the Internet allows you to be more familiar with an industry than even those living there. For instance, when it comes to assessing the quality of AI chatbots, there is no better resource than LMSYS Chatbot Arena's leaderboard.

3. Open Capital Account

Hong Kong has no capital controls, unlike Mainland China. Investors can freely move their money to wherever it gets the highest return.

Hong Kong has nearly double the number of family offices compared to rival Singapore8. The smart money knows where to go.9

4. Low Corruption

Hong Kong ranks as the least corrupt place in East Asia (#17 globally), beating out Japan (#20), Taiwan (#25), the US (#28), South Korea (#30), and Mainland China (#7610). Low corruption means that laws protect you and your rights, and you don’t need to have connections to get things done.

In fact, if you are ever solicited for a bribe11, even by an employee of a private company, or offered a bribe by anyone, you can report that to the Independent Commission Against Corruption (ICAC), and your counterparty will be investigated by the ICAC. The ICAC is obligated to keep your identity and your complaint strictly confidential (廉署保密,密密實實).

5. One Country, Two Systems is Here to Stay

One of the biggest concerns fueling the 2019 protests was what would happen to HK after 2047, 50 years after the 1997 handover. Specifically, the fear was that the city be reintegrated back into China and lose “its English common law legal system, its low tax rate and open markets”.

In 2022, Beijing made it clear that One Country, Two Systems is here to stay.

The End of Borrowed Time

For decades, one phrase hauntingly described Hong Kong: "a borrowed place on borrowed time." This sentiment stemmed from real-world deadlines. First, as a British colony with a lease set to expire in 1997, and later, as a Special Administrative Region with a "One Country, Two Systems" framework guaranteed for 50 years, until 2047. This timeline always cast a shadow of uncertainty over the city's long-term future, creating a persistent question mark for long-term investors and residents alike.

That chapter has decisively closed following the implementation of the National Security Law and the city's return to normalcy and order. Now, there is a clear and strong sense of permanence. The message is unequivocal:

The unique, devolved system of government defined by institutions fundamentally different from mainland China, such as Hong Kong’s common law tradition, open markets, and an open capital account, is not a temporary arrangement but an enduring model for the future.

This newfound stability provides an unshakable foundation with which to put down roots. The question is no longer "what happens after 2047?" but rather "how do we build on this stable, enduring foundation?" For businesses, investors, and families looking to plant deep roots, the time is no longer borrowed. Hong Kong's future is its own, and it is here to stay.

About

Inverteum Limited (HK) is a trading firm that specializes in long-short algorithmic strategies to generate returns in both bull and bear markets.

We have generated 50%+ annualized returns since inception.

How We Invest

1. Minimize allocation to individual stocks due to their unpredictability

2. Build the most suitable trading strategy and go all in. Here's an example.

3. Be prepared for bear markets and ensure profitability during bad times by implement a short selling component to the strategy

2025 International Arbitration Survey. White & Case LLP and the School of International Arbitration at Queen Mary University of London.

Why not live and invest from Singapore? While Singapore is a great place to live and invest from, Southeast Asia is considerably less prosperous and safe compared to East Asia, and it is unlikely that it will catch up to East Asia economically.

Case in point: While both HK and Singapore were both British crown colonies, London granted Singapore self-governance in 1959 but maintained full control of HK until 1997 because of HK's highly strategic location as a gateway to China.

HK's location is still highly strategic today for the same reason: China. The logic the British used in the 1950s for keeping HK and giving up Singapore is even more valid today, given that China is the world’s 2nd largest economy nominally and the largest by purchasing power today.

“Hong Kong took fourth place in 2018, chosen by 28% of respondents”. This rose to 50% in 2021. White & Case LLP.

“As the longest-serving governor in Hong Kong’s history, he was a true reformer, one whose policies shaped the city we know today. The MTR, the Independent Commission Against Corruption, district councils, country parks, labour tribunals, public health care, universal education, public housing, arts and cultural facilities, even Chinese as an official language – all of these were introduced or greatly expanded under MacLehose’s administration.” Zolima City Mag.

“Trump 2.0 could help dial down the temperature over the Taiwan issue, which Beijing considers the most important red line in bilateral ties.” Wang Xiangwei's Thought of the Day on China.

ChatGPT is inaccessible without a VPN because OpenAI has cut off access to HK users. Poe, Perplexity, LMArena.ai, and X’s Grok are all accessible in HK without a VPN.

“By far the most inconvenient thing about visiting China is internet access. As a foreigner, basically all the websites you might find useful are behind the firewall.”

“Between these internet issues and the need to use a burner phone and laptop, I would be quite reluctant to use China as a remote work location.” Dwarkesh Podcast.

“Hong Kong had more than 2,700 single-family offices – corporations established to pursue investment, philanthropy and succession planning – at the end of last year, according to a study published by Deloitte in March, compared with about 1,400 single-family offices in Singapore at the end of last year, according to the Monetary Authority of Singapore.” South China Morning Post.

I fundamentally disagree with any characterization of HK as a tax haven. HK taxes are very reasonable but certainly not the lowest in the world.

HK corporate tax is 16.5%, only 4.5 percentage points lower than the US corporate tax rate of 21%.

HK has property tax of 15% of annual rental value.

Before 2024, homebuyers paid up to 30% tax on residential property purchases.

HK has a set of investor-friendly policies like no tax on capital gains and dividends, but these policies are equally available in other places, including US territory Puerto Rico.

In Hong Kong, unlike in the US, all companies, whether public or private, need to be audited by a third-party CPA firm every year.

Here's the catch: if a company has tax-exempt income from offshore sources, that means a Hong Kong-licensed CPA signed off on it, putting their career and license on the line. They're responsible for any mistakes or irregularities.

So, you can imagine how this system helps keep things honest and eliminates a lot of sneaky behavior.

Transparency’s #76 ranking for Mainland China is somewhat misleading, as a significant amount of corruption in China works as an incentive for government employees to grow the local economy.

Visited over ten years ago and still dreaming of the dim sum I had there!

Interesting. Definitely gonna have to visit HK then