Speculative Bubbles Can End Up Growing Your Wealth

Markets are mad, and that’s OK, maybe even a good thing

There’s something timeless about speculative bubbles. Like the changing of the seasons or the rotation of the earth, they’re a constant feature of markets. Whether it’s tulips, tech stocks, crypto, or the latest AI-powered widget, bubbles emerge, inflate, and (eventually) pop. Asset prices don’t rise forever in a straight line, and yet, time and time again, we convince ourselves that this time is different (and sometimes, this time really is different).

Bubbles aren’t just about math, though. They’re about people—human psychology, herd behavior, and the eternal tug-of-war between greed and fear. No matter how sophisticated we believe our markets or algorithms have become, bubbles keep showing up because human nature doesn’t change.

If Isaac Newton, one of history’s smartest people, couldn’t resist jumping back into the South Sea bubble, losing a fortune in the process, what hope do the rest of us have?

“I can calculate the motions of the heavenly bodies, but not the madness of the people.” – Isaac Newton

But here’s the thing: bubbles aren’t just dangerous pitfalls to avoid. They’re also opportunities. And if you play them right—or, more importantly, avoid playing them wrong—they can actually be a powerful tool for building wealth.

Conventional Wisdom Is Wrong About Bubbles

If you’ve ever read an investing manual or listened to your risk-averse uncle, you’ve probably heard something like this: “Avoid bubbles at all costs.” Sounds reasonable, right? After all, no one wants to be the last person holding the bag when the music stops.

But here’s the problem: avoiding bubbles entirely is nearly impossible. Watching your neighbor get rich while you sit on the sidelines is…not fun. It’s also psychologically excruciating. During the South Sea Bubble, Newton initially made a tidy 100% profit by selling early. But as the stock kept climbing, he couldn’t resist the pull of FOMO. He bought back in, lost the equivalent of millions of dollars in today’s money, and spent the rest of his life forbidding anyone to mention the words “South Sea” in his presence.

If Newton couldn’t resist the Siren call of speculative mania, what makes you think you can?

Bubbles Can Create Wealth, Even Last

Here’s the awkward truth about bubbles: they’re not all bad. In fact, a well-inflated bubble can do wonders for wealth creation—at least for those who know how to ride the wave.

“Whenever I see a bubble forming, I rush in to buy.” – George Soros1

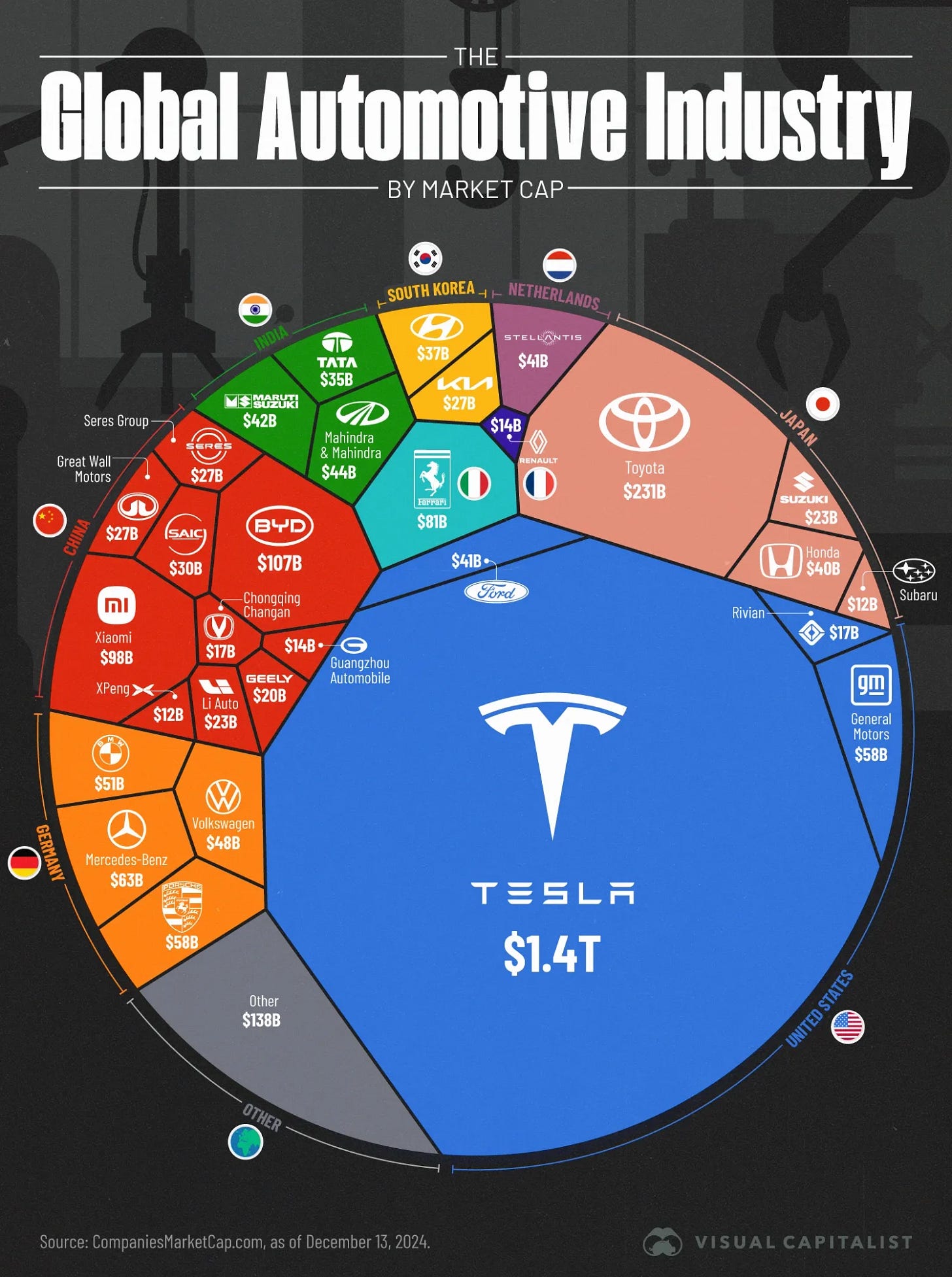

Take Tesla, for example. For years, critics dismissed the company as a bubble waiting to pop. And yet, investor enthusiasm (or mania, if you prefer) helped Tesla raise billions of dollars, scale production, become profitable, and achieve a market cap of $1.4 trillion—nearly as much as the rest of the auto industry combined.

Fundamental investors who bet against Tesla’s “bubble” have lost a staggering $63 billion shorting the stock since its IPO in 2010.

“Markets can remain irrational longer than you can remain solvent.”

- John Maynard Keynes

Something that starts out looking like a bubble could end up being worth a lot, so avoiding all potential bubbles could wind up being very costly to your net worth.

How to Survive (and Thrive) in a Bubble

So, how do you handle bubbles without losing your shirt? The answer lies somewhere between Newton’s despair and Soros’s enthusiasm.

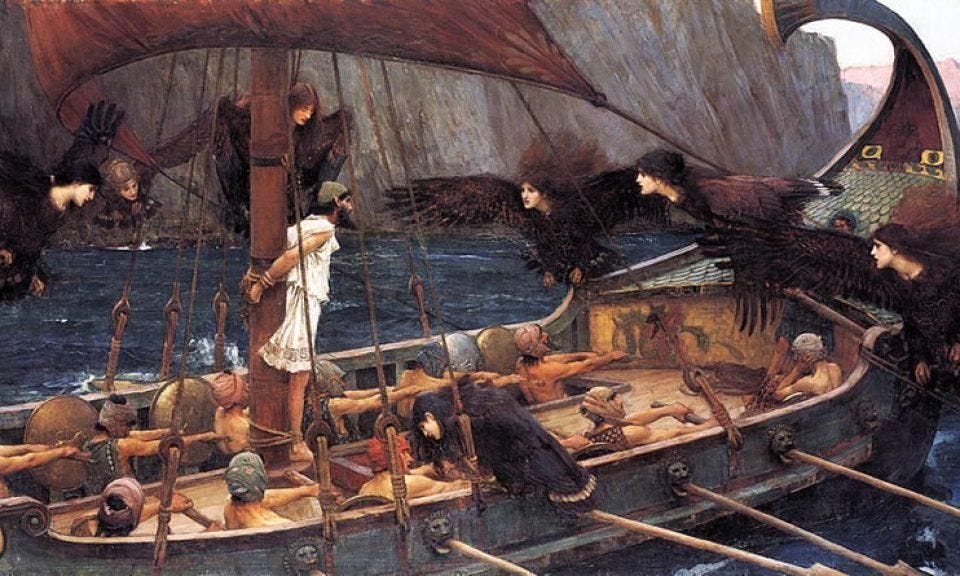

Think of bubbles like the Sirens in Greek mythology.

"The Sirens of Greek mythology are infamous for their deadly ability to lure sailors to their doom. These half-woman, half-bird creatures lived on rocky islands, where they used their enchanting songs and mesmerizing voices to attract sailors, causing them to crash their ships on the jagged coastlines or drown as they drew closer to the irresistible sound."

Just as bubbles appeal to investors' desire for riches, "the Sirens would tap into the deepest desires and longings of their victims."

In Homer’s Odyssey, Odysseus wanted to hear the Sirens’ song but knew the danger. So, he had his crew plug their ears with beeswax and tie him to the mast of his ship. No matter how much he begged, the crew wouldn’t untie him until they were safely past the Sirens’ island.

When it comes to bubbles, you need to be like Odysseus. Want to buy into the hype? Fine—but tie yourself to the mast first. Here’s how:

Diversify. Don’t put all your eggs in one bubble. Keep the bulk of your portfolio in more stable, long-term investments like index funds.

Hedge. Consider adding a short component to your strategy. If you’re buying into a bubble, make sure you set a stop-loss.

Take profits. Don’t get greedy. If you’ve made a windfall from one skyrocketing asset, take some chips off the table and reinvest in a more diversified strategy. You can’t lose money you’ve already cashed out.

This way, you can participate in the wealth creation in bubbles while being hurt less if they burst.

The Bottom Line

Bubbles aren’t going away. They’re an inevitable part of markets, fueled by human psychology and the irresistible allure of easy riches. But instead of trying to avoid them entirely, you can learn to navigate them—carefully, with a healthy dose of skepticism and a plan for when things go south.

Because at the end of the day, bubbles are like fire. Mishandled, they can burn your portfolio to the ground. But harnessed correctly, they can light the way to great fortunes.

About

Inverteum Limited (HK) is a trading firm that specializes in long-short algorithmic strategies to generate returns in both bull and bear markets.

Inverteum has generated 52% annualized returns (39% after fees) since inception.

How We Invest

Minimize allocation to individual stocks due to their unpredictability

Build the most suitable trading strategy and go all in. Here's a sample trading strategy.

Be prepared for bear markets and ensure profitability during bad times by implementing a short selling component to the strategy.

By buying into a bubble, Soros aims to capitalize on the momentum created by investor sentiment, which can drive prices higher even if they deviate from fundamental values. This strategy relies on the understanding that bubbles can be profitable if exited at the right time, despite their eventual collapse.

Love this.

Bubble is in the eye of the beholder.

Some of the bubble-callers’ reluctance comes from not being an active, diversified investor with a good stock monitoring system.

Maybe just add stop losses? 😭🤣

Omg thank you for writing this! Been feeling bad about "prematurely" selling my crypto at a 100% profit so your perspective really helps :)