The Bull Market Is Over. Now Comes the Fun Part.

Tariffs, inflation, and mean reversion are setting up a major correction

This post is for informational purposes only and does not constitute investment advice. The author is not responsible for any investment decisions made by readers based on the information contained herein. Investing involves risk, and you could lose money. Do your own research and consult with a financial professional before investing.

A Material Change in Market Sentiment

Since the market’s peak in mid-February, we’ve seen a material shift in sentiment. The S&P 500 is down 8%; the Nasdaq-100 is down 12%. Most importantly, both benchmarks have spent several trading sessions below the all-important 200-day moving average.

“Nothing good happens below the 200-day moving average.” — Common trader wisdom

The last time we saw a bull run of over two years end1 was in early 2022, right before the tech bear market.

The Market Is Looking Ahead, and It Doesn't Like What It Sees

Markets are ever forward-looking, constantly repricing risk and opportunity. In 2022, the fear was inflation and the rate hikes needed to contain it. This time, the concerns are different but still worrisome.

Steve Cohen, the billionaire owner of Point72 Asset Management, put it bluntly in February 2025:

“When you take a brew of tariffs […] slowing immigration […] and DOGE—that’s austerity—we think growth is going to slow to 1-1.5% from 2.5% in the second half, so I’m actually pretty negative for the first time in a while. It may only last a year or so, but I think the best gains have been had. It wouldn’t surprise me to see a significant correction.”

The weakness in the economy was already severe enough to cost the incumbent president’s party (Democrats) the election. Now, additional policy shifts—tariffs and DOGE—could lead to a bear market.

DOGE: The Austerity You Didn’t See Coming

US Treasury Secretary Scott Bessent has said that, “Every $300 billion we cut is about a percent of GDP.”

According to DOGE Tracker, DOGE has already cut $115 billion in spending. That’s about 0.4% of GDP. DOGE’s goal is $2 trillion in cuts. That’s almost 7% of GDP.

Investors, understandably, are a little spooked.

If Congress actually follows through on slashing trillions in spending, that’s a structural drag on growth that market participants need to price in.

And they are.

The last time the government got serious about austerity—after the financial crisis, when deficit hawks insisted on reigning in spending—the result was sluggish growth and repeated market tantrums every time a debt ceiling fight or budget showdown loomed.

This time, it’s happening again, but with higher interest rates, sticky inflation, and a market that’s already looking for reasons to sell off.

If you’re wondering why stocks are struggling, DOGE is a big part of the answer.

Tariffs: Inflation’s Unwelcome Friend

Tariffs are a fascinating economic lever, mostly because they rarely work as intended. The goal is to make foreign goods more expensive so that domestic manufacturing thrives. The real-world result is that consumers end up paying more, while businesses adjust their supply chains in ways politicians didn’t expect.

Higher prices from tariffs can make it harder for the Federal Reserve to cut interest rates. But in theory, tariffs could also cause “demand destruction,” which might cap inflation—though that's a tricky bet.

The problem is that the link between consumer demand and pricing isn’t always as strong as you’d think. Some industries, particularly those with a high degree of consolidation, would rather sell fewer units at higher margins than lower prices to maintain volume.

Take two examples:

1. Cars. In 2024, the average price of a new car was $48,205—up 21% from 2019.

"Automakers aren’t sufficiently motivated to solve the affordability crisis because they’re making more money selling fewer cars to richer buyers."2

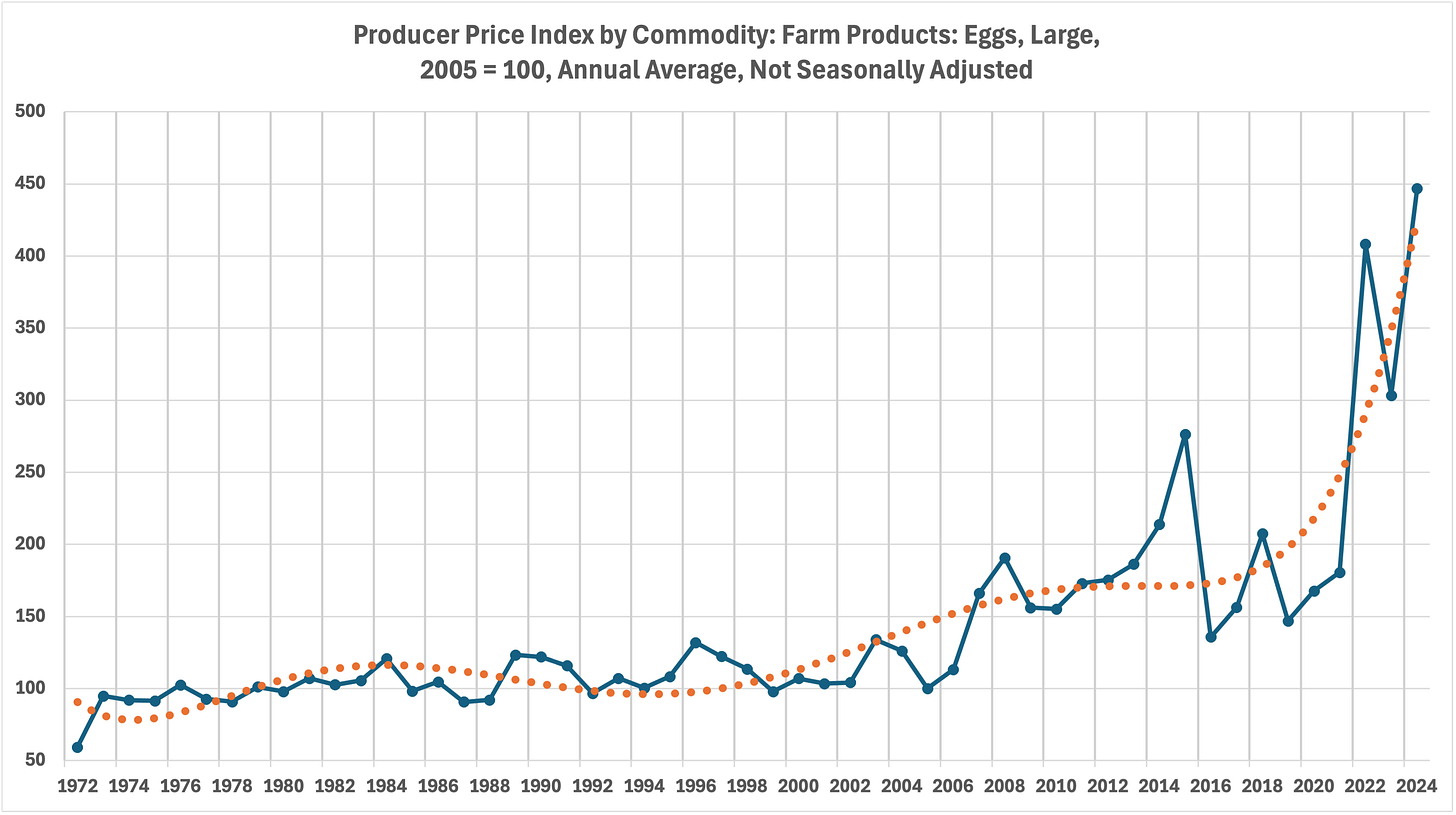

2. Eggs. The egg industry is effectively a duopoly that has reduced the number of hens available to egg producers by 19% since 20213. Unsurprisingly, the price of eggs has risen significantly4.

In these cases, demand destruction not only wouldn't reduce inflation; demand destruction and the subsequent inflation—reducing supply to increase prices—is the goal of the businesses involved.

Unlike in his first term, Trump cares much less about Wall Street than Main Street, which largely does not own stocks and does not follow the market. They voted for higher tariffs because they believe it will bring back American manufacturing jobs. Whether they’re right or wrong, the market doesn’t like it.

The way things are going, stagflation—a mix of stagnant growth and persistent inflation—isn’t out of the question.

Mean Reversion and the "Mag 7"

The Magnificent Seven—Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla—have carried the market for two years. But even the best trades don’t go up forever.

On March 1, 2025, Chamath Palihapitiya commented on the state of these stocks:

“Mag 7 is really priced to perfection, so you have to believe that the world kind of stays the way that it is, otherwise you're going to have some amount of mean reversion.”

Mean reversion suggests that the stocks that ran up the most—like Nvidia and Meta—could also fall the hardest. It remains to be seen whether investors will still believe in AI, cloud computing, and digital advertising at the multiple expansion levels they’ve been willing to pay.

The Economic Outlook Is Just Not Great

The macro backdrop is about as unfavorable as it gets for the stock/bond ratio; heightened uncertainty, reform-like policy moves, and declining economic confidence makes the risk of recession a real possibility (and the Treasury Secretary is basically telling us this).

If the President and his Treasury Secretary are emotionally preparing the American public for a recession, it’s probably not wise to bet against it.

The Party Isn’t Over—It’s Just Getting Started

If you’re a long-only investor, this might be bad news. But if your strategy alternates between long and short, this is when things get interesting.

To be clear, shorting isn’t for everyone. It’s painful, expensive, and, in a bull market, a spectacular way to lose money. But when the market turns south, it becomes the only real way to generate returns.

We don’t short stocks because we enjoy it; we’re not Peter Schiff or Michael Burry. But it’s our job to deliver returns in both bull and bear markets. And in 2025, that means we might very well need to invoke the short component of Inverteum’s long/short trading strategy.

If you enjoyed this analysis, please tap the Like button below ♥️ Thank you!

This post is for informational purposes only and does not constitute investment advice. The author is not responsible for any investment decisions made by readers based on the information contained herein. Investing involves risk, and you could lose money. Do your own research and consult with a financial professional before investing.

About

Inverteum Limited (HK) is a trading firm that specializes in long-short algorithmic strategies to generate returns in both bull and bear markets.

We have generated 52% annualized returns (39% after fees) since inception.

The end of a bull run is defined as a prolonged period above the 200-day moving average immediately followed by at least five trading sessions below it for both the S&P 500 and Nasdaq-100.

March 30, 2025 update: 25% tariffs on imported cars and car parts are estimated to increase the average new car price by $5-10k. Buckle up for more inflation.

"Since the onset of the 2022 [avian flu] epidemic, hatcheries — now under the exclusive control of EWG and Hendrix — have seemingly done everything they can to throttle the supply of chicks to egg producers rather than expand it. The size of the flock of “parent” hens — the hens used by hatcheries to produce layer chicks for egg producers — plummeted from 3.1 million hens in 2021, to 2.9 million in 2022, to 2.5 million hens in 2023 and 2024."

There have been material changes to this thesis since it was published in mid-March. Elon is leaving DOGE. Most importantly, Trump is softening his rhetoric on China tariffs.

The market is now pricing in a set of circumstances quite different from a month ago: more limited tariffs, a Trump administration more responsive to the demands of businesses, and no more government spending cuts due to DOGE.

The upside of using a long-short strategy is the ability to change on a dime when circumstances change. In this way, volatility becomes your friend rather than the bane of your existence.

Great analysis. Agreed that the bull market is over but what comes next is tough to predict! Personally, if we unwind decades of globalization, I see the trends of resilience, reshoring & sovereignty and China as long term winners. But it could take time to play out! Looking forward to reading your next articles!